Gold punches through $3,800 an ounce as risk of US shutdown rattles markets

PositiveFinancial Markets

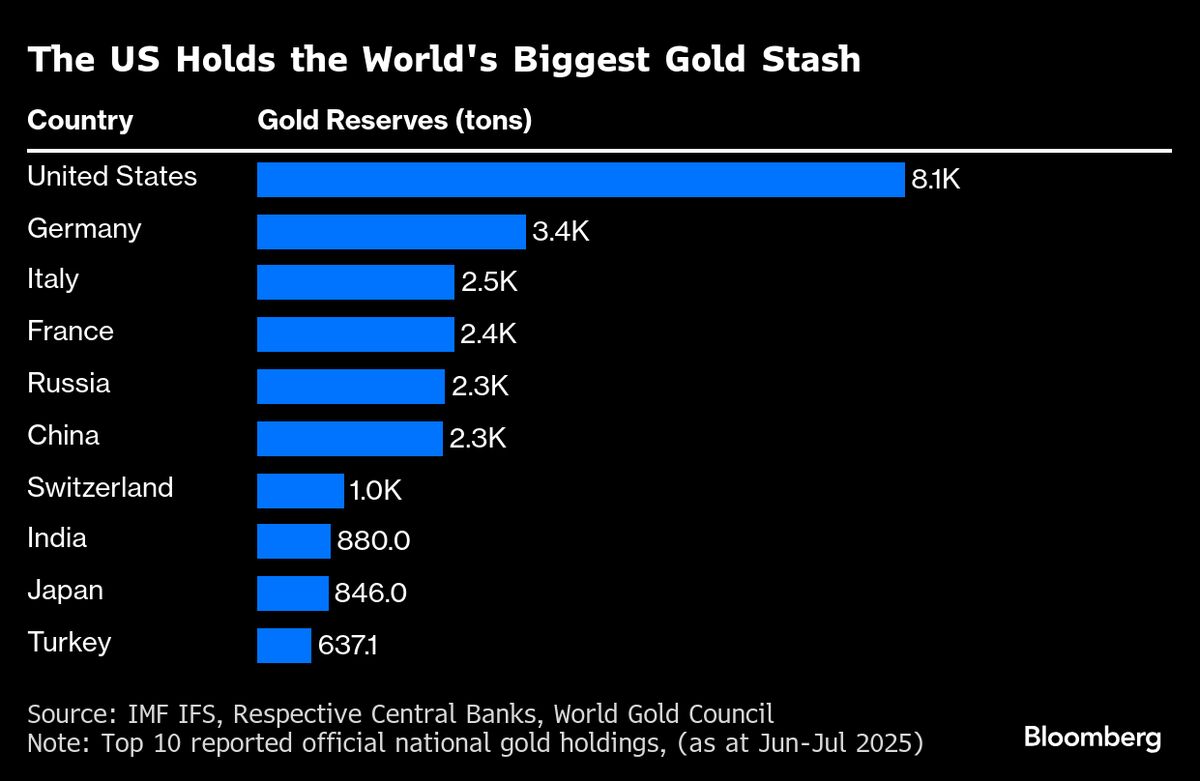

Gold prices have surged past $3,800 an ounce, driven by concerns over a potential US government shutdown and increased demand from ETFs and central banks. This rally highlights the precious metal's role as a safe haven during times of uncertainty, making it a crucial asset for investors looking to protect their wealth amidst market volatility.

— Curated by the World Pulse Now AI Editorial System