Ferrari reveals Elettrica but dials down 2030 electrification goals

NeutralFinancial Markets

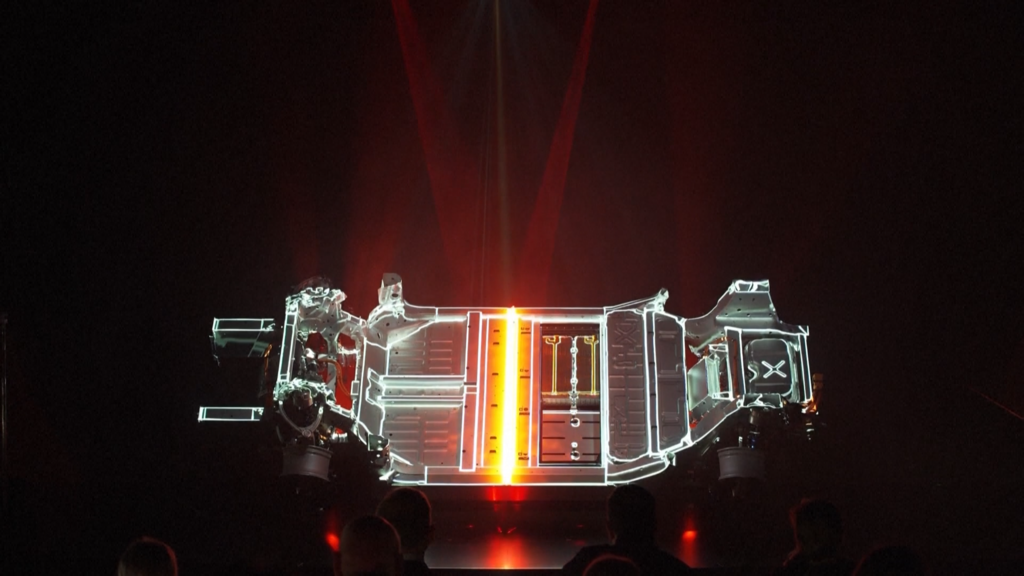

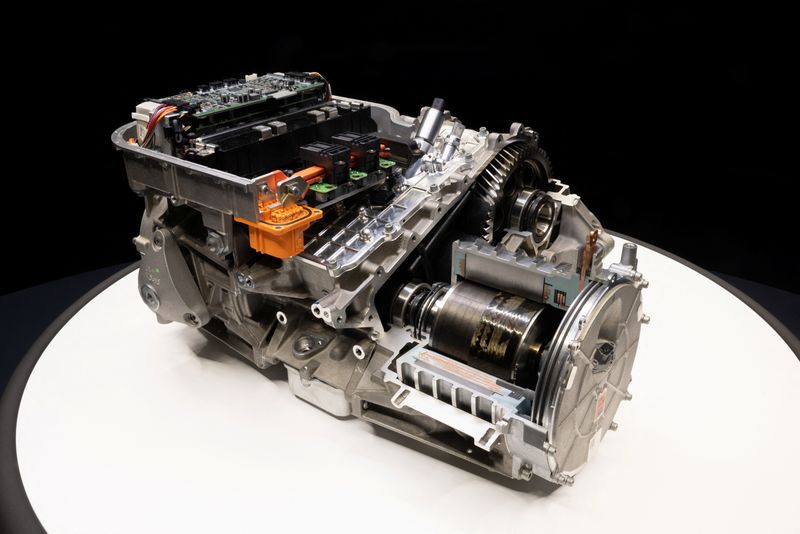

Ferrari has unveiled its new electric model, the Elettrica, showcasing its commitment to electric vehicles. However, the company has tempered its electrification goals for 2030, indicating a more cautious approach to transitioning its lineup. This matters as it reflects the balance luxury automakers must strike between innovation and maintaining brand identity, especially in a rapidly changing automotive landscape.

— Curated by the World Pulse Now AI Editorial System