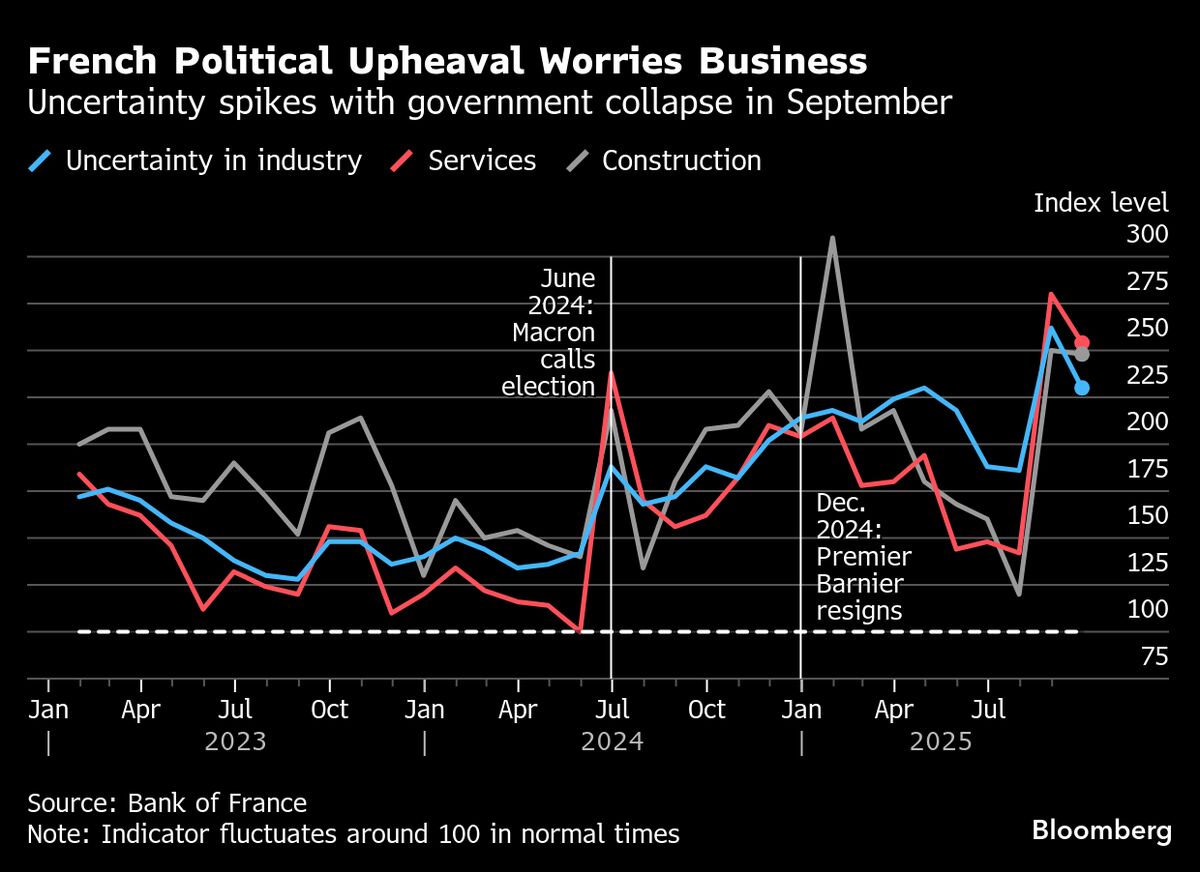

French Economy Is Weathering Political Crisis, Central Bank Says

PositiveFinancial Markets

Despite the ongoing political crisis, France's economy has shown remarkable resilience, according to the central bank. This positive outlook is significant as it indicates that the economic fundamentals are strong enough to withstand political uncertainties, which is crucial for maintaining investor confidence and stability in the region.

— Curated by the World Pulse Now AI Editorial System