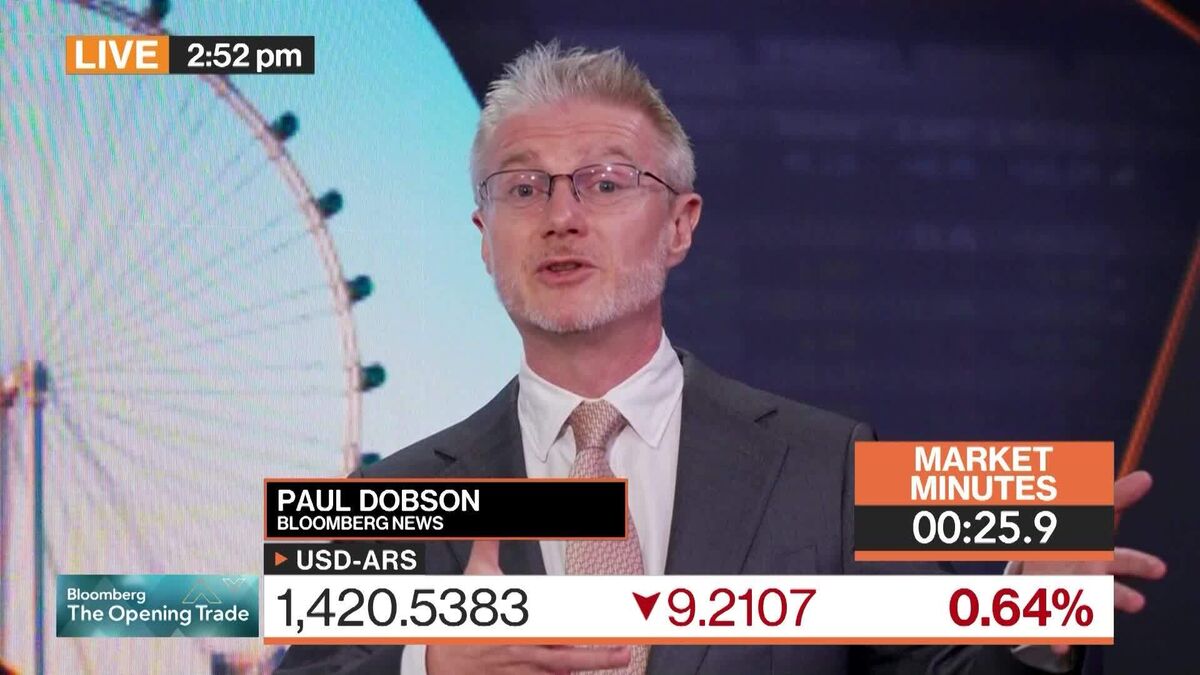

U.S. launches financial rescue of Argentina, Treasury buys pesos

PositiveFinancial Markets

The U.S. has stepped in to support Argentina with a significant $20 billion currency swap agreement, as announced by Treasury Secretary Scott Bessent. This move is crucial for stabilizing Argentina's economy and strengthening its currency, which has faced challenges in recent years. By providing this financial assistance, the U.S. aims to foster economic stability in the region, which can have positive ripple effects for trade and investment.

— Curated by the World Pulse Now AI Editorial System