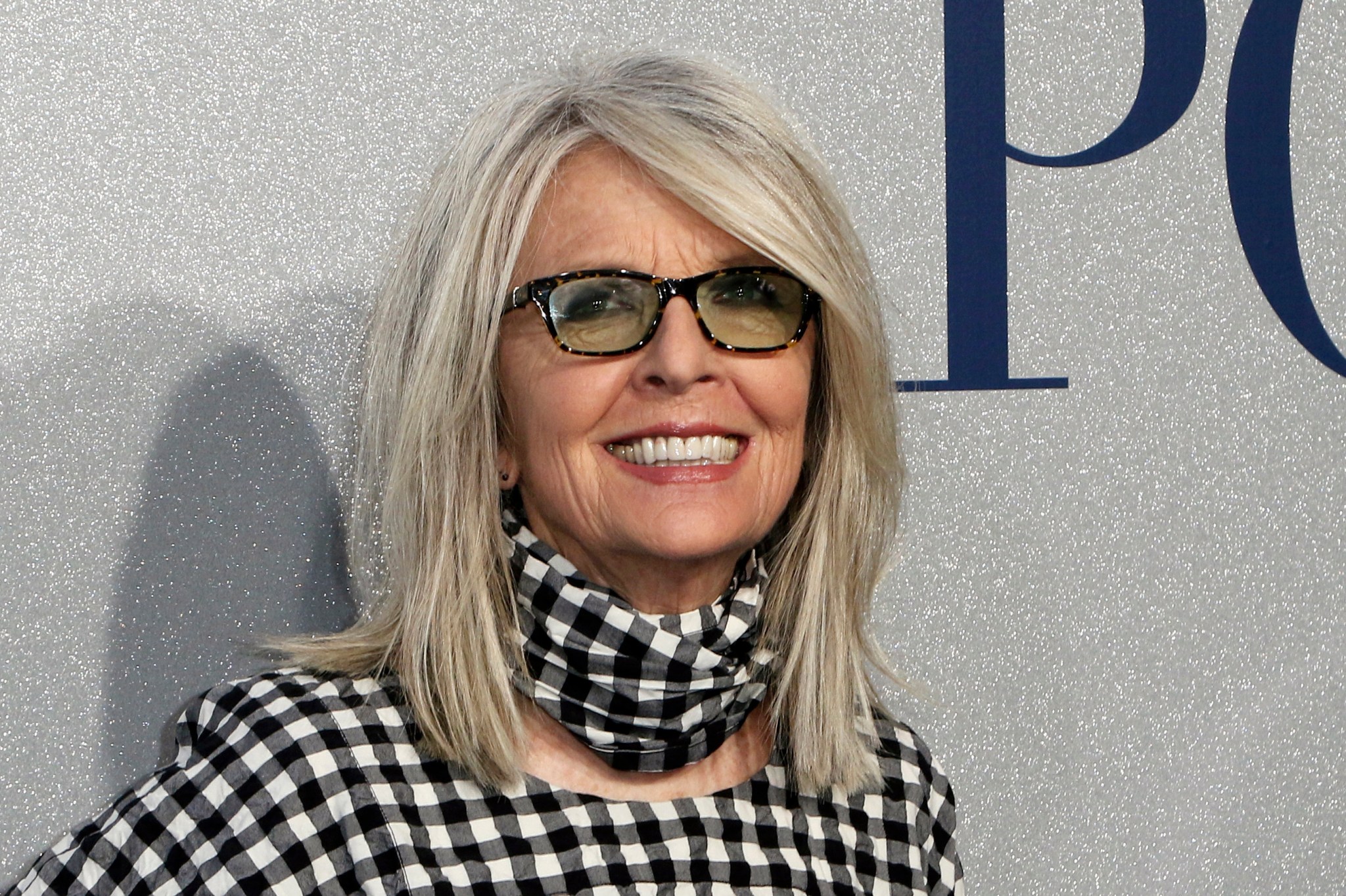

This sector ’remains unfavored’ by investors despite strong fundamentals says UBS

NegativeFinancial Markets

Despite strong fundamentals, UBS reports that a particular sector continues to be unfavored by investors. This is significant as it highlights a disconnect between market performance and investor sentiment, suggesting potential opportunities for those willing to look beyond current trends.

— Curated by the World Pulse Now AI Editorial System