Critics Say Select Investors Gained From US Aid to Argentina

NegativeFinancial Markets

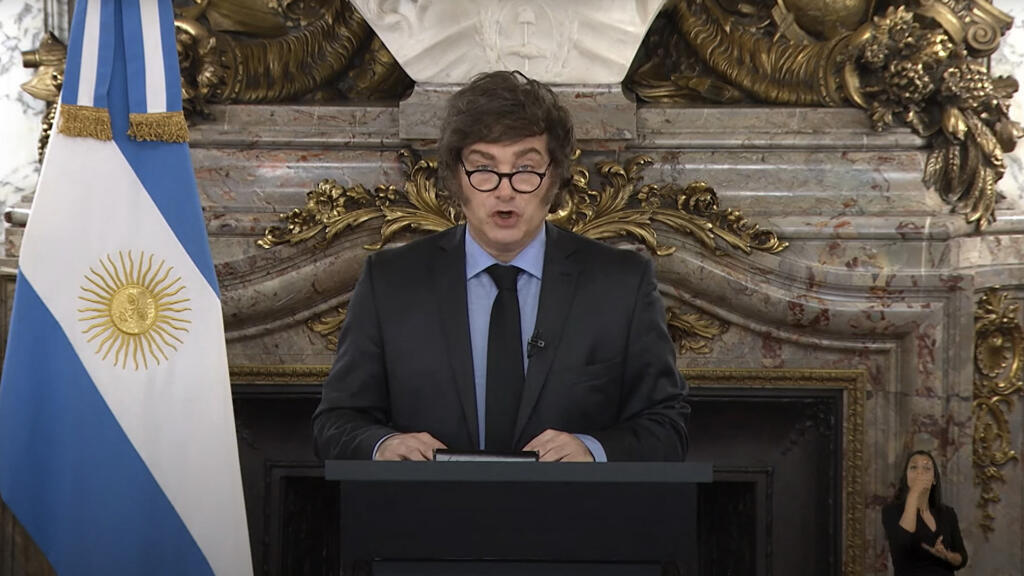

Critics are raising concerns that the U.S. financial aid to Argentina may disproportionately benefit select investors, particularly those connected to Treasury Secretary Scott Bessent. While the U.S. aims to stabilize Argentina for broader geopolitical reasons, the potential for favoritism in financial support has sparked debate about the fairness and transparency of such aid. This situation highlights the complexities of international financial assistance and the need for accountability.

— Curated by the World Pulse Now AI Editorial System