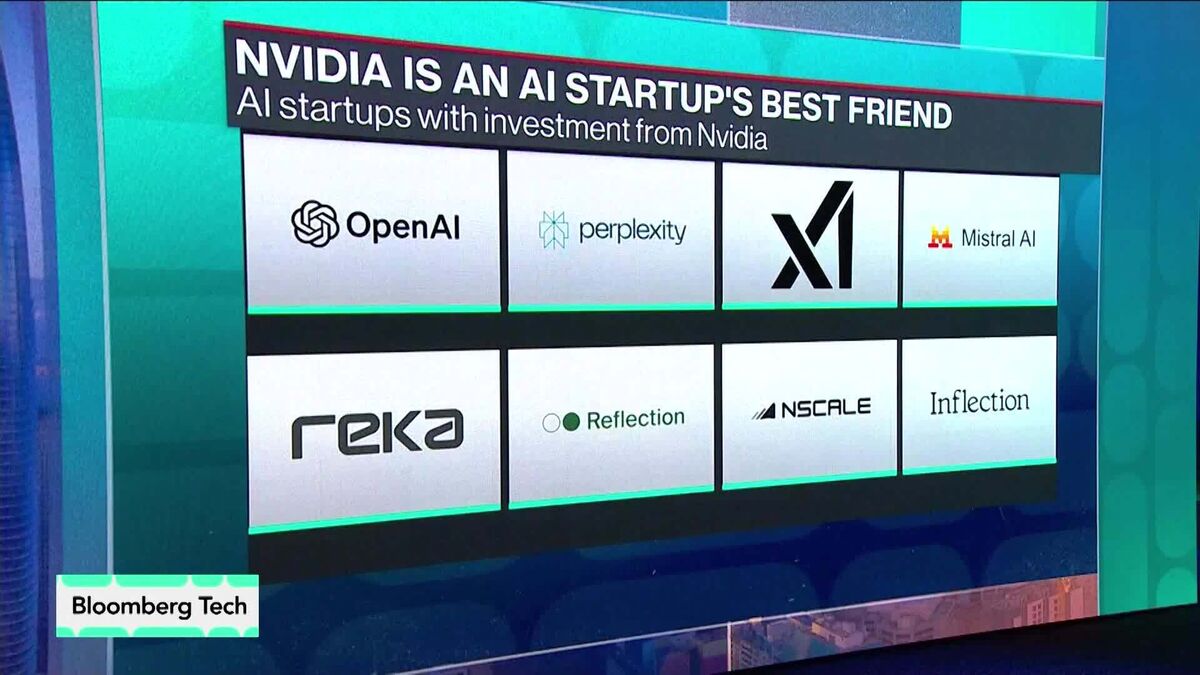

Nvidia Becomes Big Venture Backer for AI Startups

PositiveFinancial Markets

Nvidia is stepping up its game in the world of artificial intelligence by significantly increasing its investments in AI startups. This move positions Nvidia as a key player in venture capital, influencing the future of technology and innovation. With experts like Seth Fiegerman from Bloomberg discussing these developments, it's clear that Nvidia's backing could lead to groundbreaking advancements in AI, making this news particularly exciting for tech enthusiasts and investors alike.

— Curated by the World Pulse Now AI Editorial System