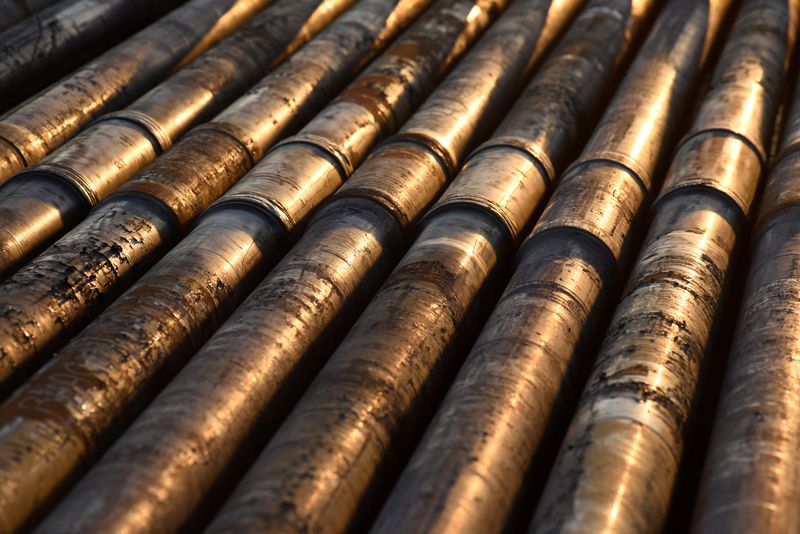

Sanctioned Russian oil giant to sell foreign assets

NeutralFinancial Markets

Lukoil, a major Russian oil producer facing sanctions, has revealed plans to sell its foreign assets under a US wind-down license. This move is significant as it reflects the ongoing impact of international sanctions on Russian businesses and the broader oil market. The sale could reshape Lukoil's operations and influence its future in the global energy landscape.

— Curated by the World Pulse Now AI Editorial System