Nvidia’s Blackwell chip to be discussed at Trump-Xi meeting

NeutralFinancial Markets

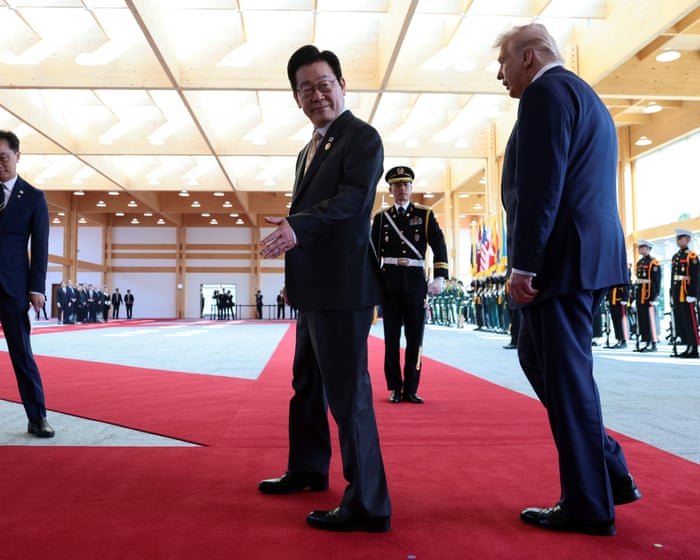

The upcoming meeting between Trump and Xi is set to include discussions about Nvidia's Blackwell chip, highlighting the intersection of technology and international relations. This matters as it reflects how advancements in tech can influence global diplomacy and economic strategies.

— Curated by the World Pulse Now AI Editorial System