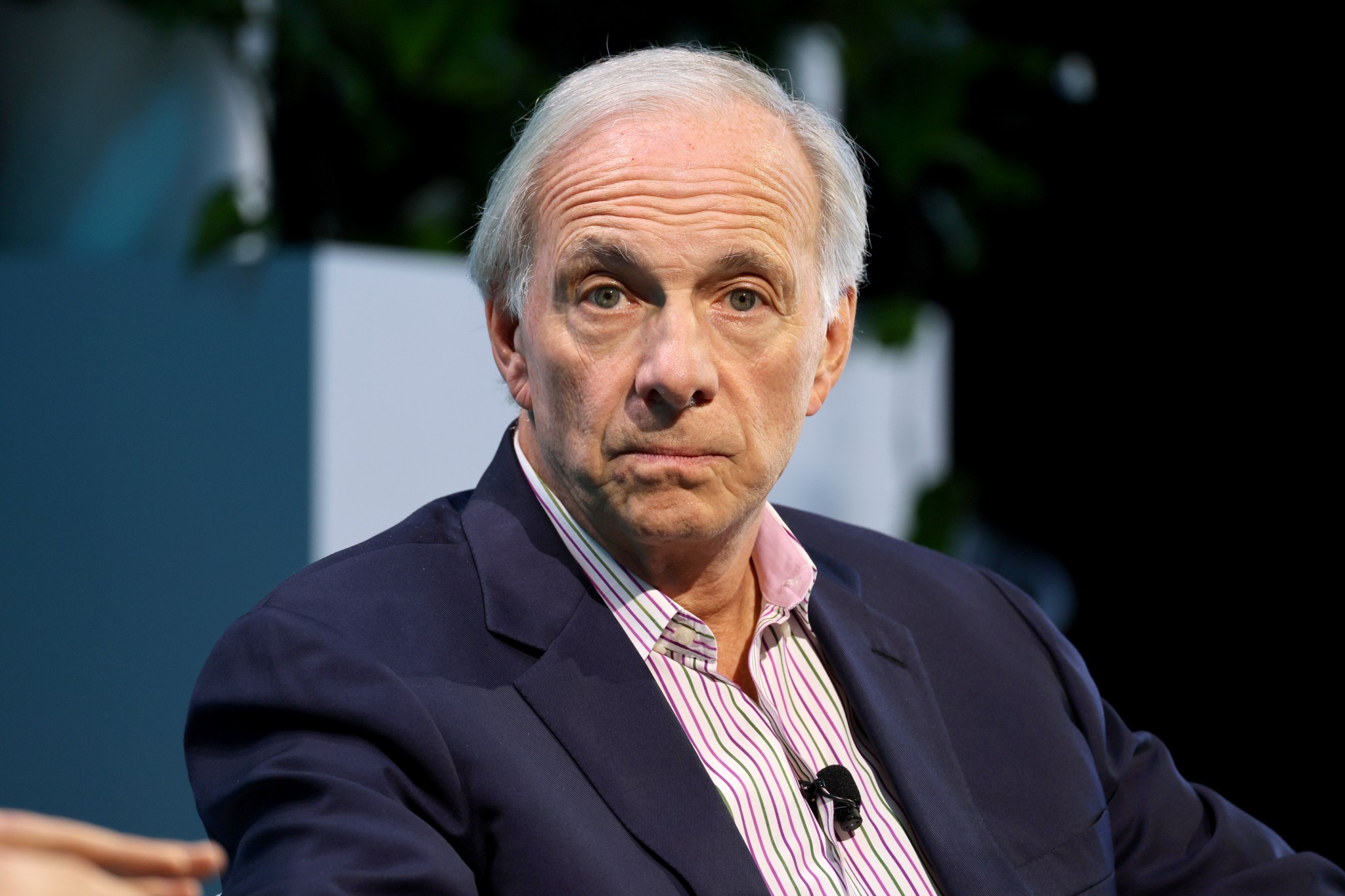

Ray Dalio says the U.S. is headed for civil war, with either side exerting ‘tests of power’ on their rivals

NegativeFinancial Markets

Ray Dalio has raised alarming concerns about the future of the United States, suggesting that the nation is on a path toward civil war. He believes that the country faces two potential outcomes: a unifying effort to overcome divisions or a scenario where opposing factions inflict maximum pain on each other. This perspective is significant as it highlights the growing polarization in American society and the urgent need for dialogue and reconciliation.

— Curated by the World Pulse Now AI Editorial System