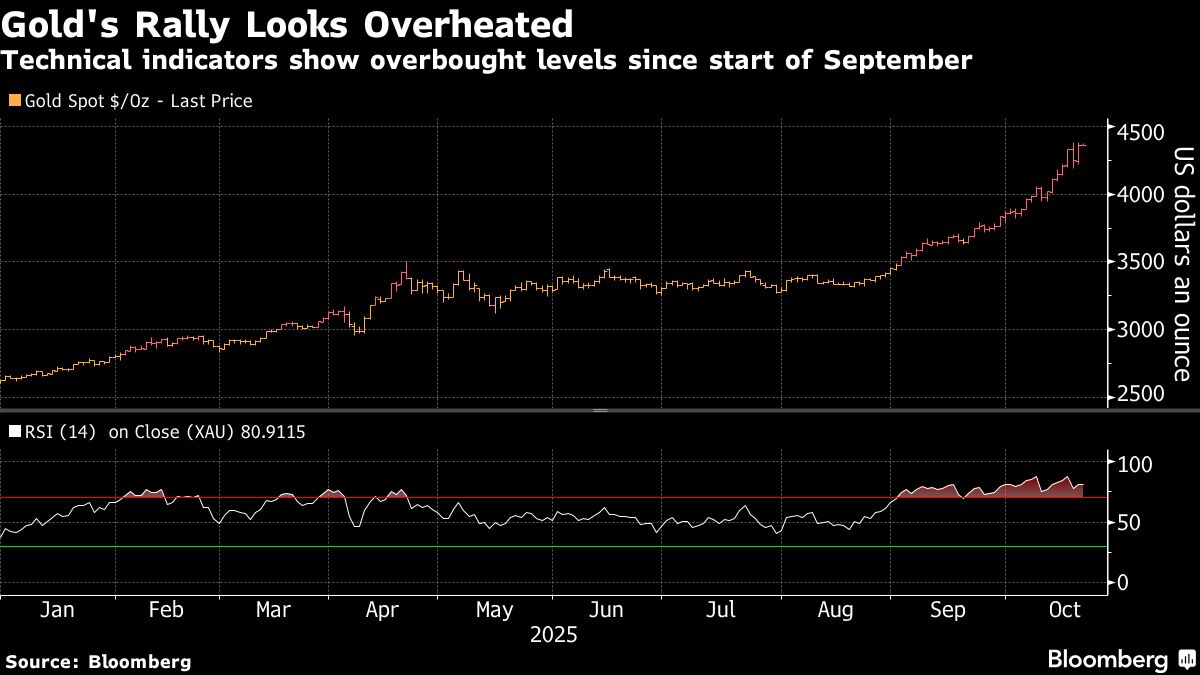

Gold’s Record-Busting Rally Resumes After Dip-Buyers Emerge

PositiveFinancial Markets

Gold prices are on the rise again, nearing record highs after a recent dip. Traders are seizing the opportunity to buy in following a sharp selloff last week, indicating strong market confidence. This rally is significant as it reflects ongoing investor interest in gold as a safe-haven asset amidst economic uncertainties.

— Curated by the World Pulse Now AI Editorial System