Horizons Middle East & Africa 10/2/2025 (Video)

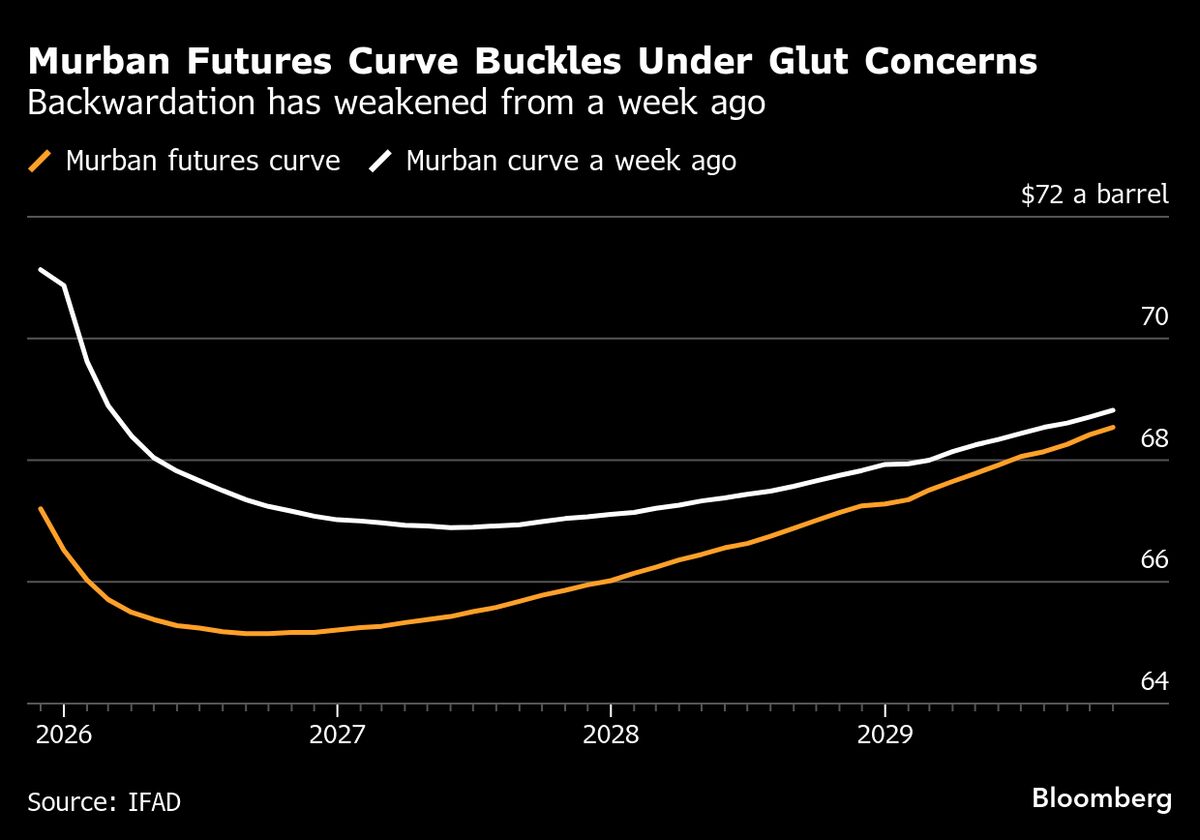

NeutralFinancial Markets

The Horizons Middle East & Africa event scheduled for October 2, 2025, is set to showcase significant developments and innovations in the region. This event matters as it brings together key stakeholders, fostering collaboration and dialogue on pressing issues affecting the Middle East and Africa, ultimately aiming to drive progress and growth.

— Curated by the World Pulse Now AI Editorial System