Unsold Oil From Middle East Hints at Early Signs of Global Glut

NegativeFinancial Markets

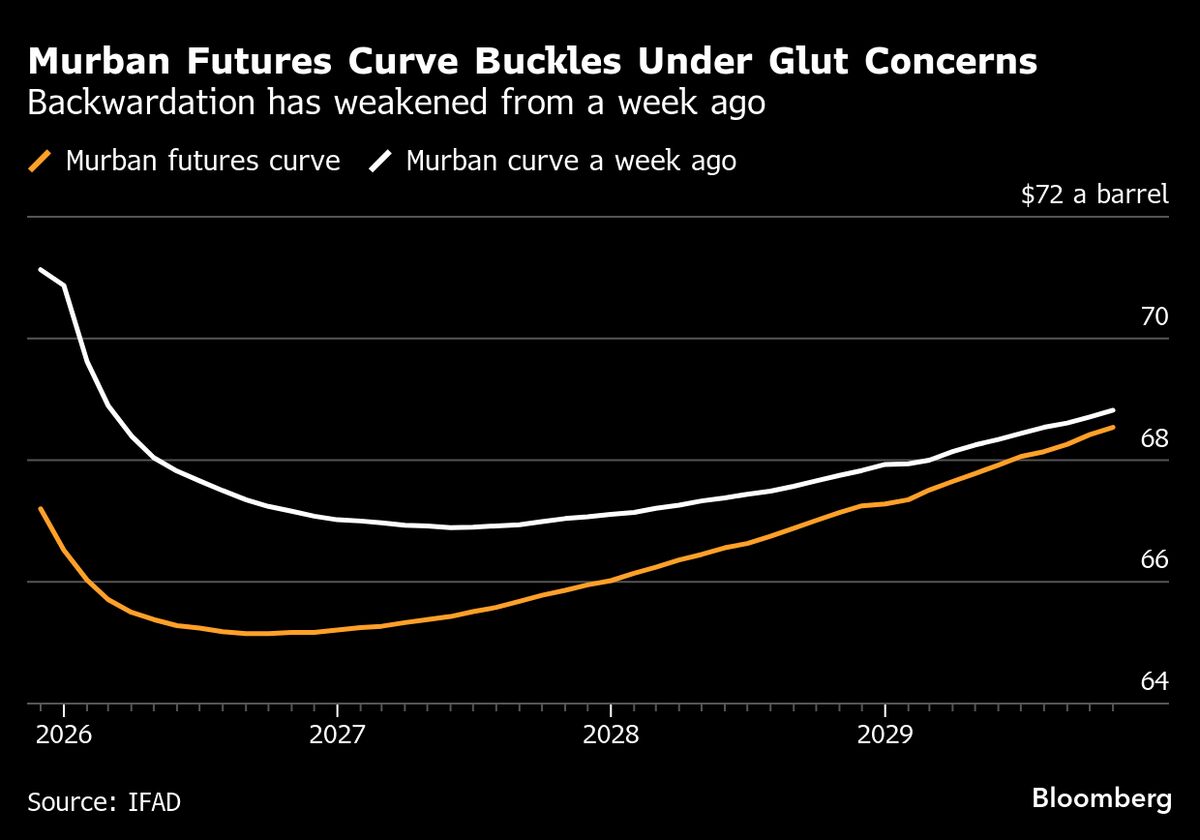

Recent reports indicate that unsold crude oil from the Middle East suggests the beginning of a global oil surplus. This development is significant as it could impact oil prices and the economies reliant on oil exports, signaling potential challenges ahead for the energy market.

— Curated by the World Pulse Now AI Editorial System