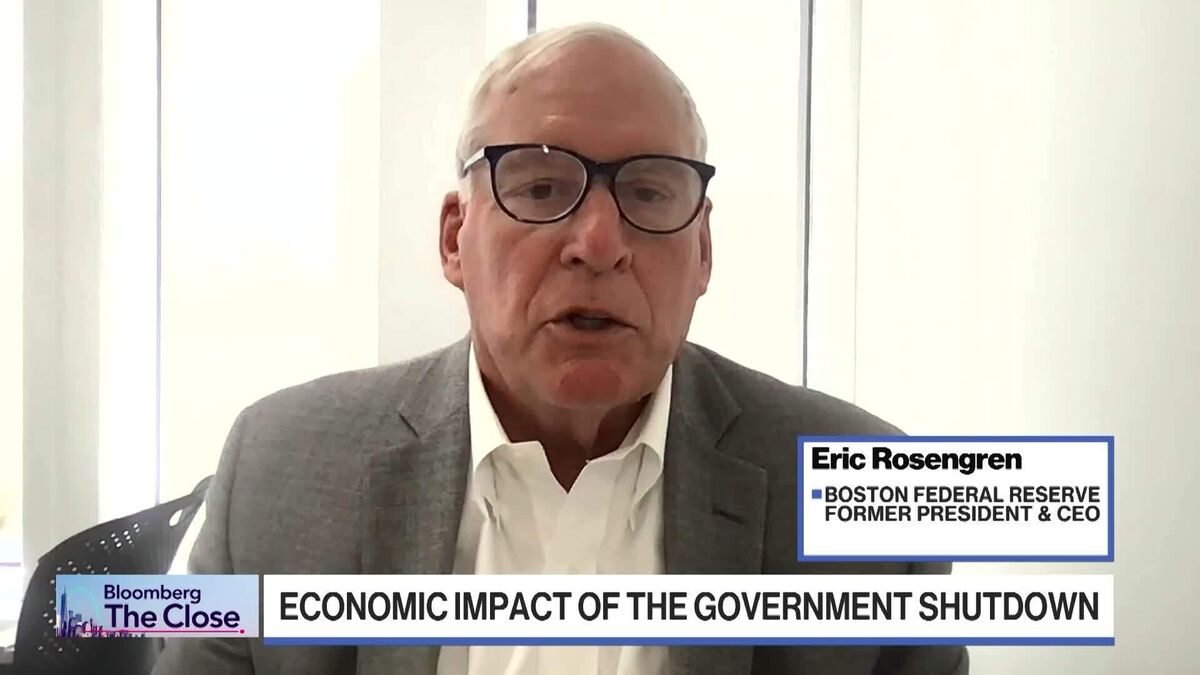

US government warns travelers of "dangerous situations" at popular destinations

NegativeFinancial Markets

The US government has issued a travel advisory warning travelers about potential dangerous situations at popular destinations. This advisory is crucial as it highlights the risks that travelers may face, encouraging them to stay informed and take necessary precautions while planning their trips.

— Curated by the World Pulse Now AI Editorial System