US Launches Financial Rescue of Argentina, Treasury Buys Pesos

PositiveFinancial Markets

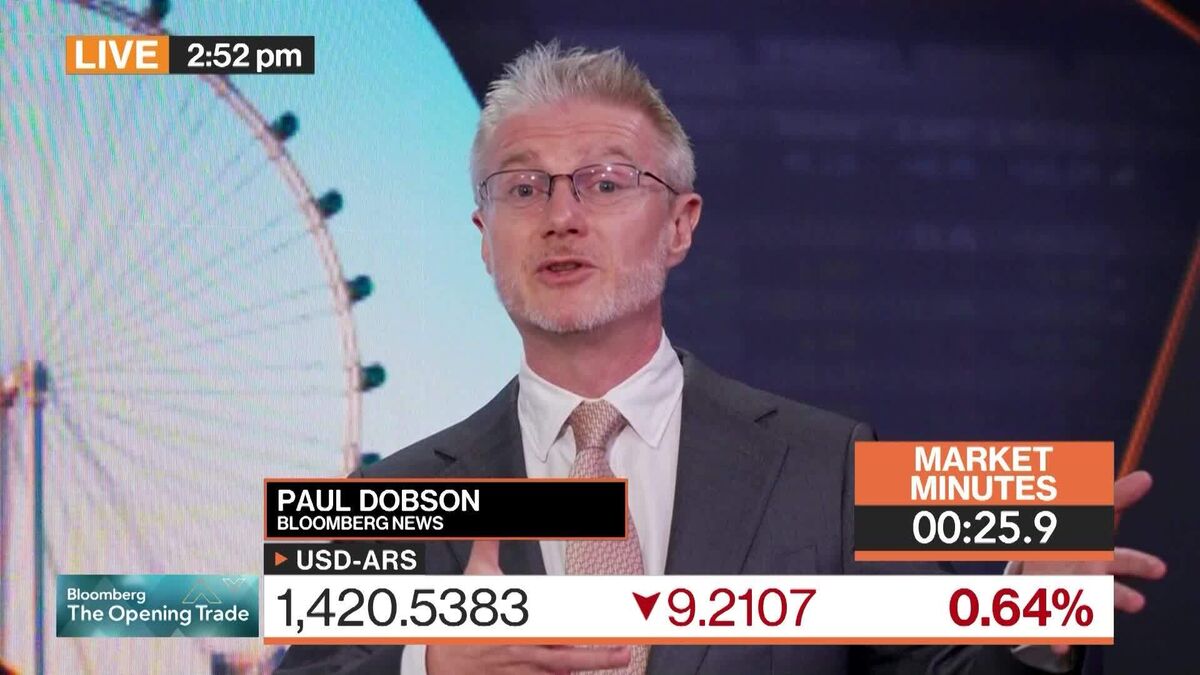

The US has stepped in to support Argentina's struggling economy by offering $20 billion in financing and intervening in currency markets to stabilize the peso. This move is significant as it aims to curb the sharp declines the currency has faced recently, reflecting a commitment to bolster economic stability in the region.

— Curated by the World Pulse Now AI Editorial System