White House layoff threats and the greatest resignation in American history highlight paycheck uncertainty—here’s how to prepare if it happens to you

NegativeFinancial Markets

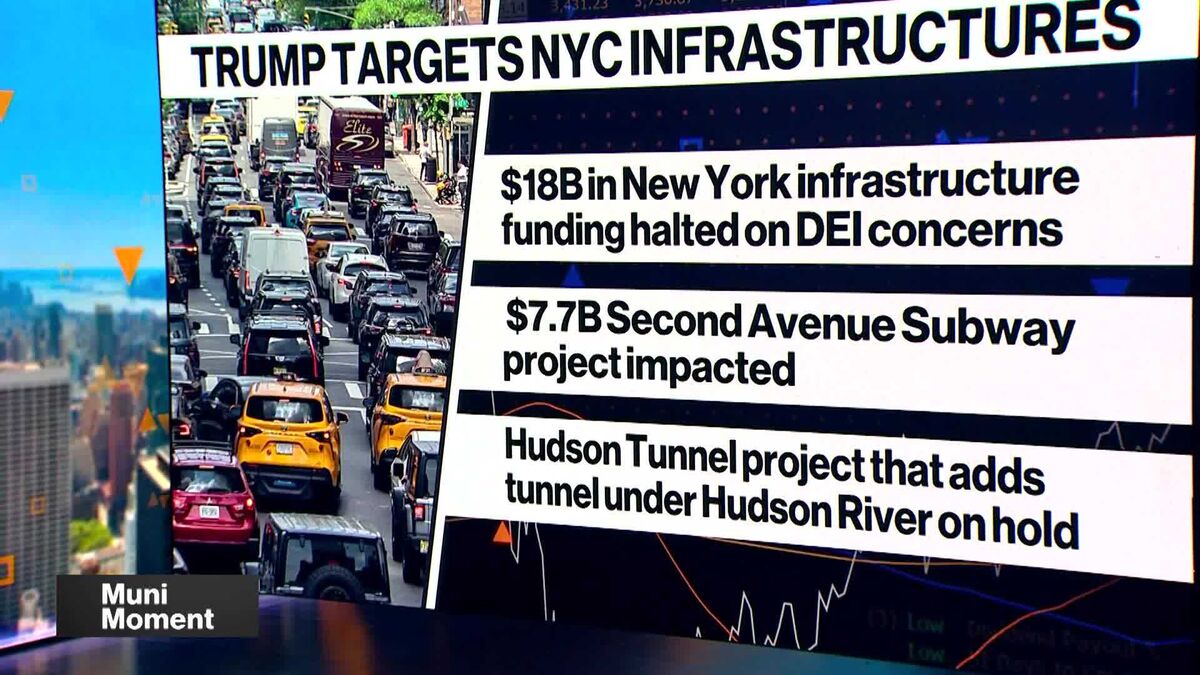

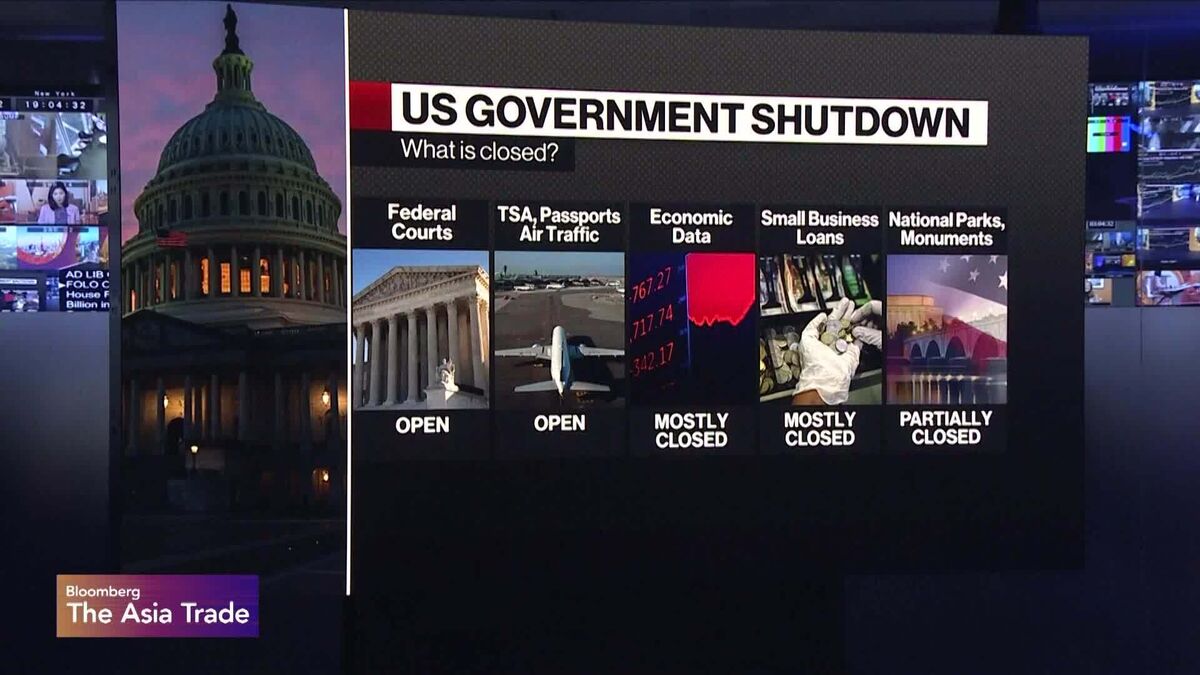

The recent threats of layoffs from the White House and the potential for a government shutdown underscore the growing uncertainty surrounding paychecks in America. With experts warning that sudden income loss can happen at any moment, it's crucial to be prepared. They suggest five essential financial steps to take immediately if your paycheck stops, helping individuals navigate these uncertain times and secure their financial future.

— Curated by the World Pulse Now AI Editorial System