Japan’s MUFG in talks to buy India’s Shriram Finance for $2.6 bln- Economic Times

PositiveFinancial Markets

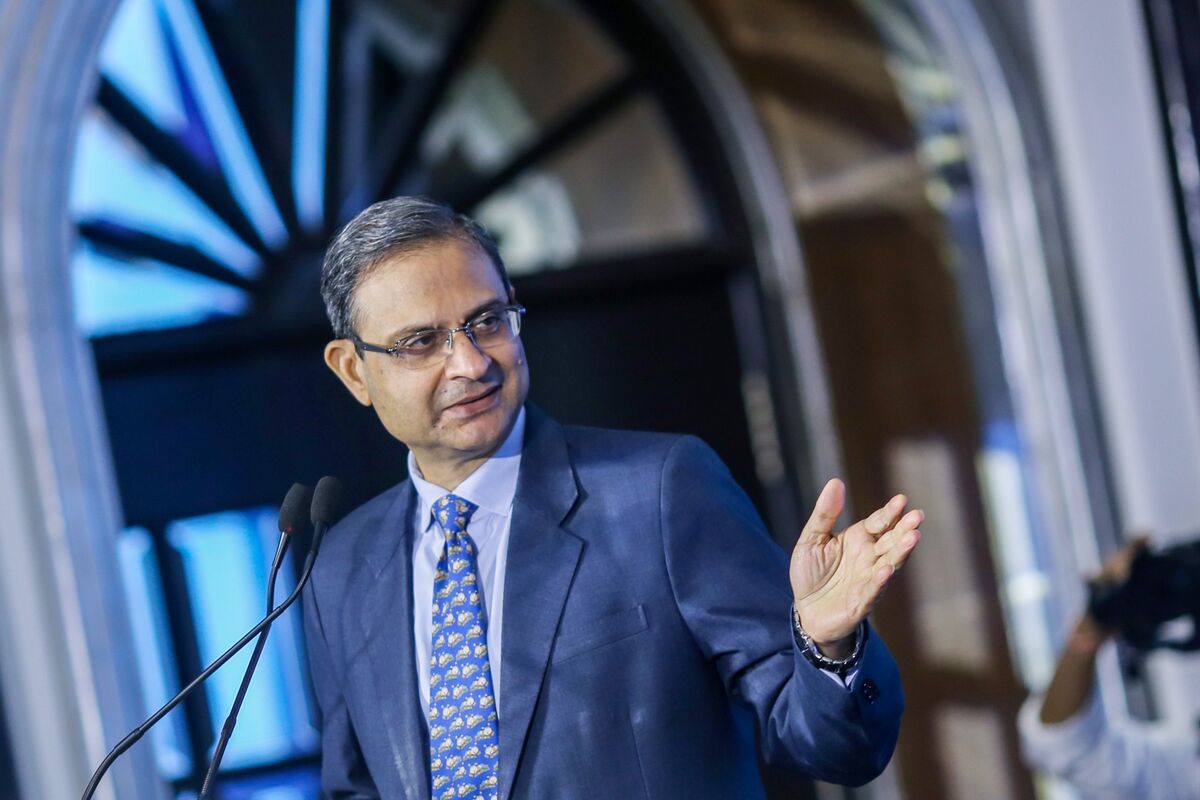

Japan's MUFG is in discussions to acquire India's Shriram Finance for $2.6 billion, marking a significant move in the financial sector. This acquisition could enhance MUFG's presence in the growing Indian market, which is crucial for its global expansion strategy. The deal highlights the increasing interest of foreign investors in India's financial services, reflecting confidence in the country's economic potential.

— Curated by the World Pulse Now AI Editorial System