ECB Rates in Good Place to Deliver Stable Inflation, Wunsch Says

PositiveFinancial Markets

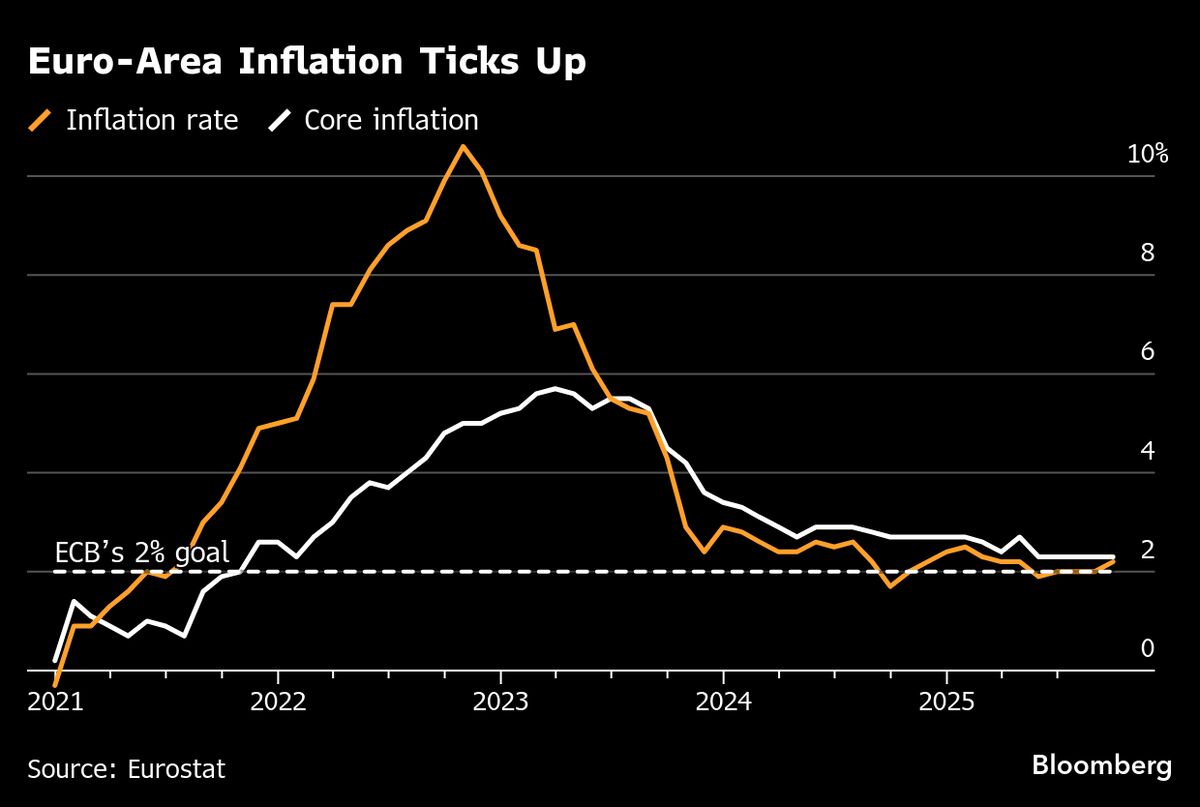

Pierre Wunsch, a member of the European Central Bank's Governing Council, has expressed confidence that the current policy settings are well-positioned to maintain consumer price inflation at the targeted 2% in the medium term. This is significant as it suggests stability in the economy, which can foster consumer confidence and investment.

— Curated by the World Pulse Now AI Editorial System