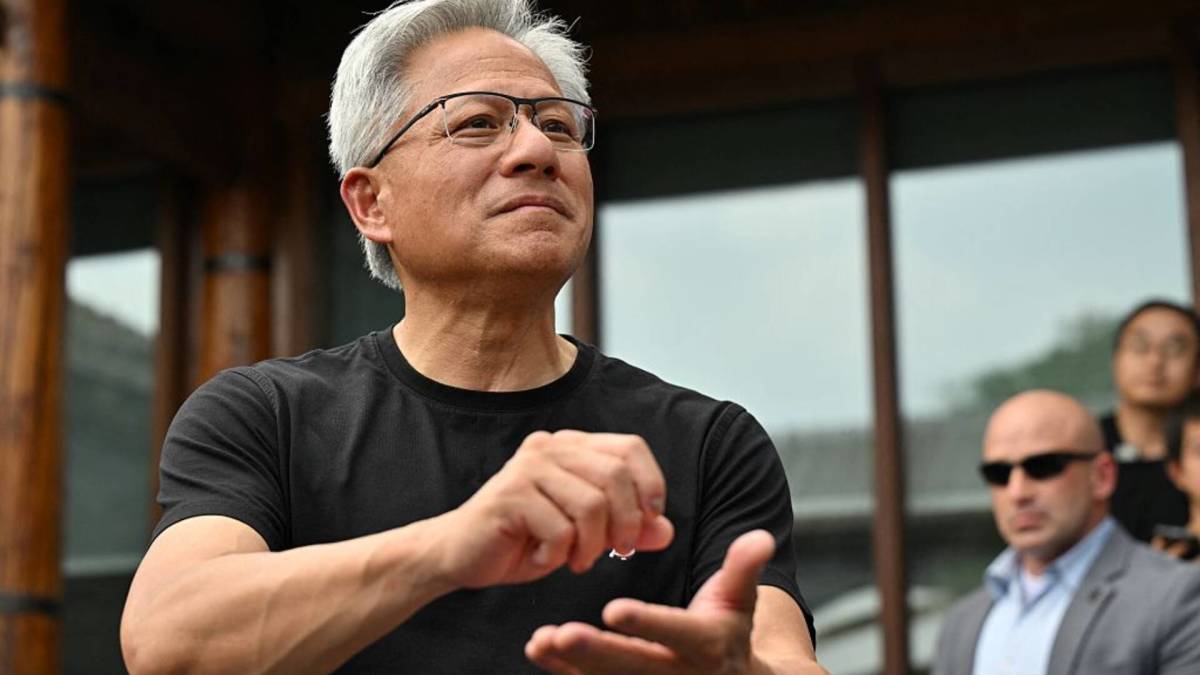

Nvidia becomes world’s first $5 trillion company

PositiveFinancial Markets

Nvidia has made headlines by becoming the world's first $5 trillion company, just months after reaching the $4 trillion mark. This remarkable achievement highlights the company's rapid growth and dominance in the tech industry, particularly in areas like artificial intelligence and graphics processing. As Nvidia continues to push boundaries, many are left wondering if such a high valuation is justified, sparking discussions about the future of technology and investment.

— Curated by the World Pulse Now AI Editorial System