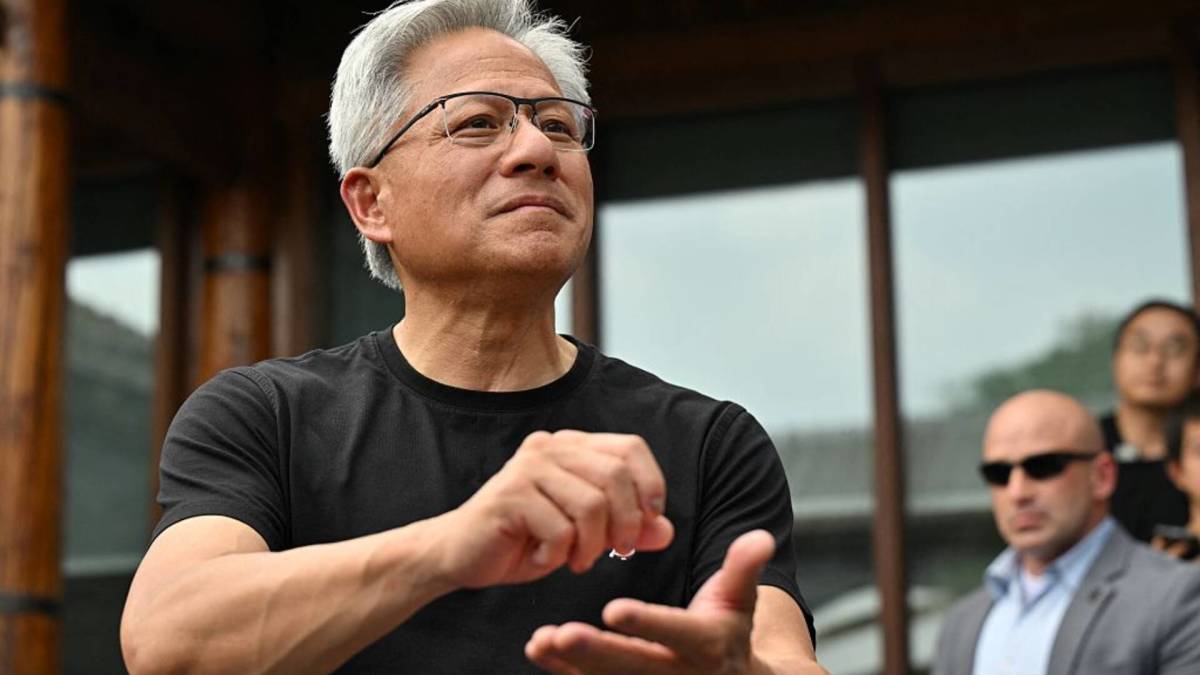

Nvidia's next big thing could be flying cars

PositiveFinancial Markets

Nvidia's CEO Jensen Huang made waves at this year's GTC showcase by unveiling ambitious plans for 'physical AI', which could lead to the development of flying cars. This innovation not only highlights Nvidia's commitment to pushing the boundaries of technology but also signifies a potential shift in how we perceive transportation and AI integration in our daily lives. As these advancements unfold, they could revolutionize industries and enhance mobility, making this a significant moment in tech history.

— Curated by the World Pulse Now AI Editorial System