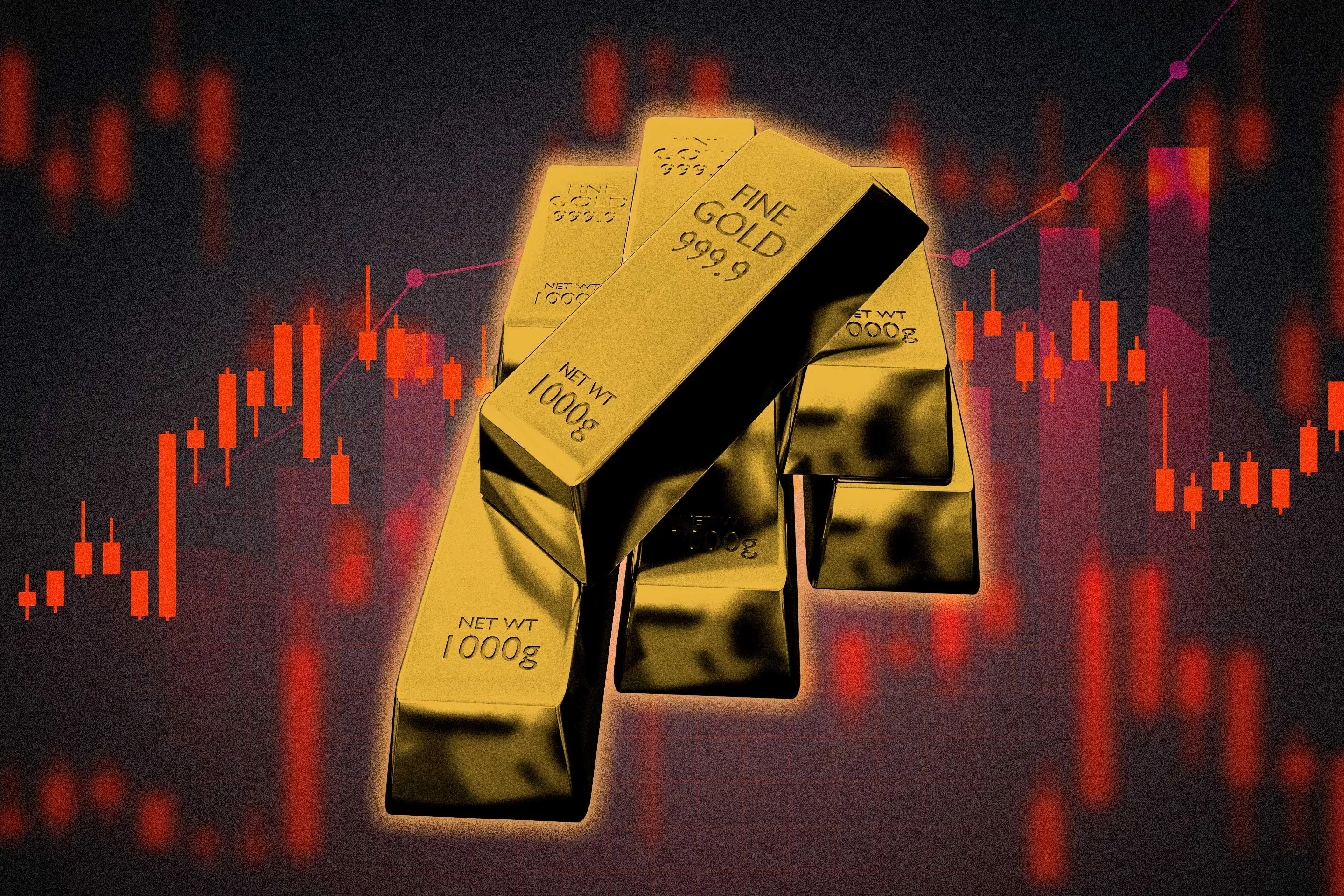

Gold Stocks Are Surging. They Still Lag Behind Cold, Hard Bullion

PositiveFinancial Markets

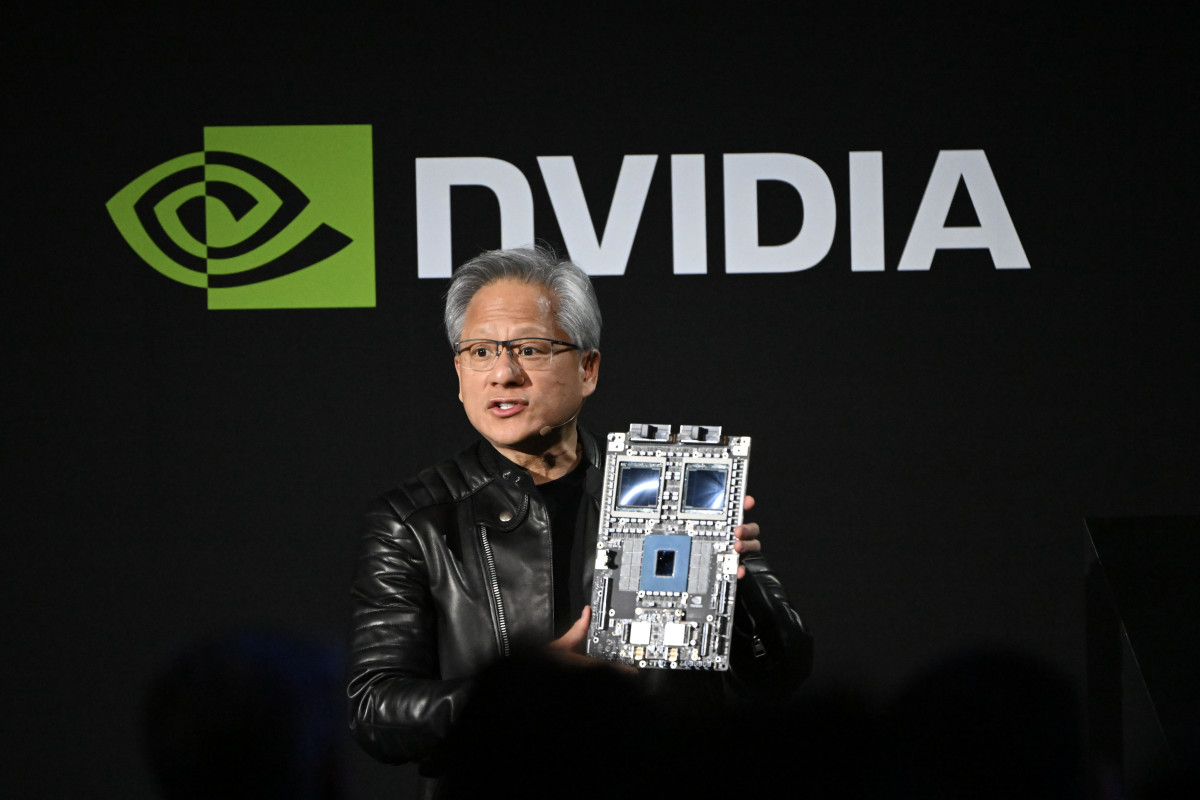

Gold stocks are experiencing a significant surge, driven by a renewed interest in gold since August. This uptick in demand for gold equities has led to gains that surpass those of chip stocks benefiting from the artificial intelligence boom. This trend is noteworthy as it highlights a shift in investor sentiment towards traditional assets like gold, which may indicate a broader market strategy amidst economic uncertainties.

— Curated by the World Pulse Now AI Editorial System