Kuwait Petroleum Sees Strong Oil Demand Justifying OPEC+ Boost

PositiveFinancial Markets

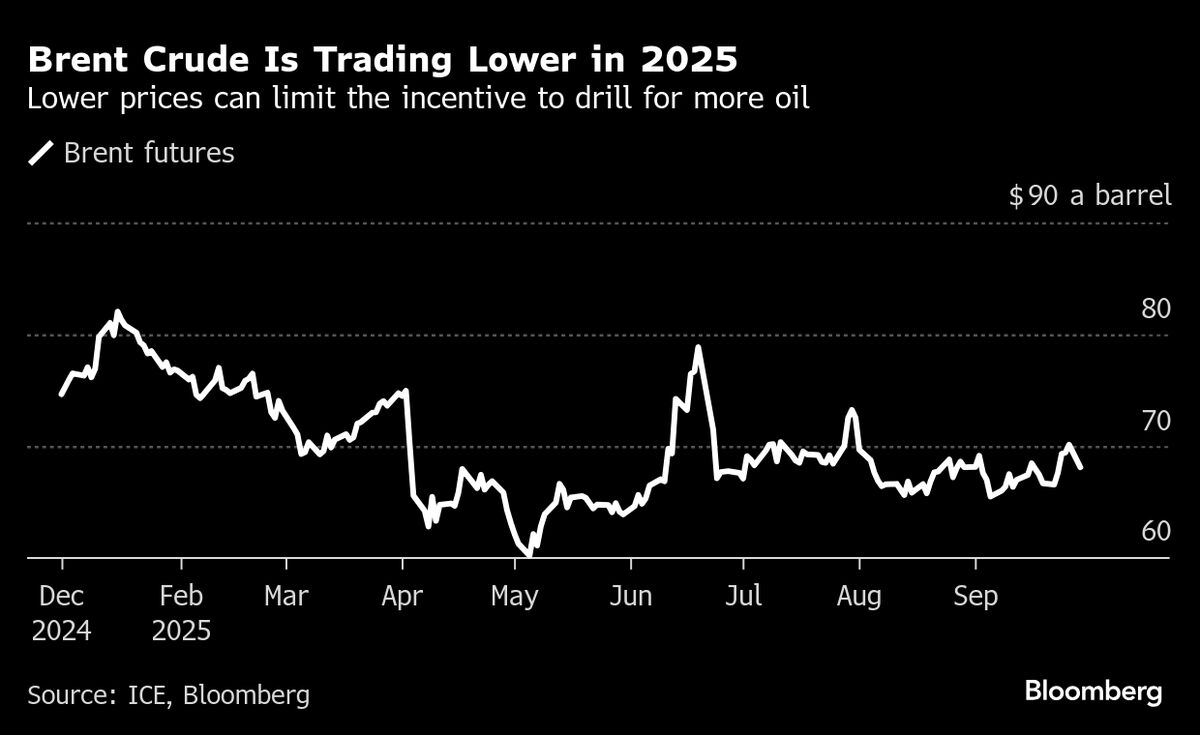

Kuwait Petroleum Corp's CEO has highlighted a robust growth in global oil demand, indicating that this trend supports the recent supply increases by OPEC+. This is significant as it suggests a healthy market for oil, which could lead to economic stability and growth for oil-producing nations.

— Curated by the World Pulse Now AI Editorial System