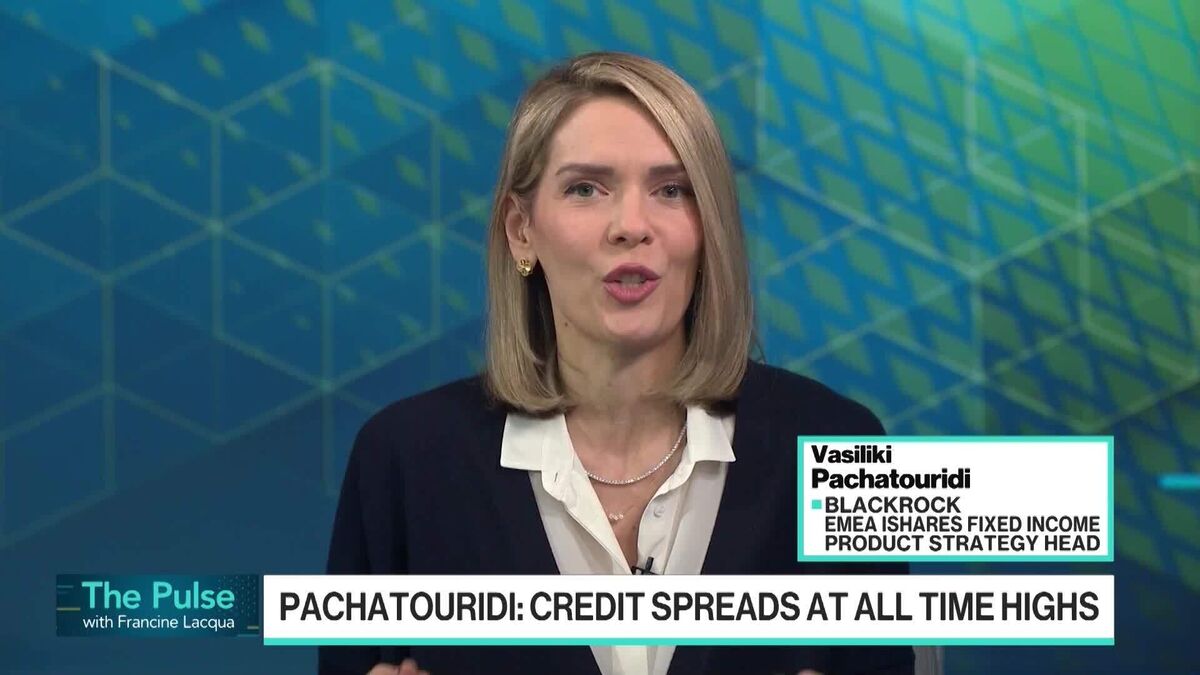

BlackRock Advises Adding CLO, CMBS to Credit Exposures

PositiveFinancial Markets

BlackRock's Vasiliki Pachatouridi has shared an optimistic outlook on fixed income markets, urging investors to diversify their credit exposures by incorporating assets like European credit, collateralized loan obligations, and commercial mortgage-backed securities. This advice is significant as it highlights the importance of diversification in investment strategies, especially in uncertain economic times, potentially leading to more stable returns for investors.

— Curated by the World Pulse Now AI Editorial System