BlackRock Says Insurers Expect to Keep Ramping Up Private Bets

PositiveFinancial Markets

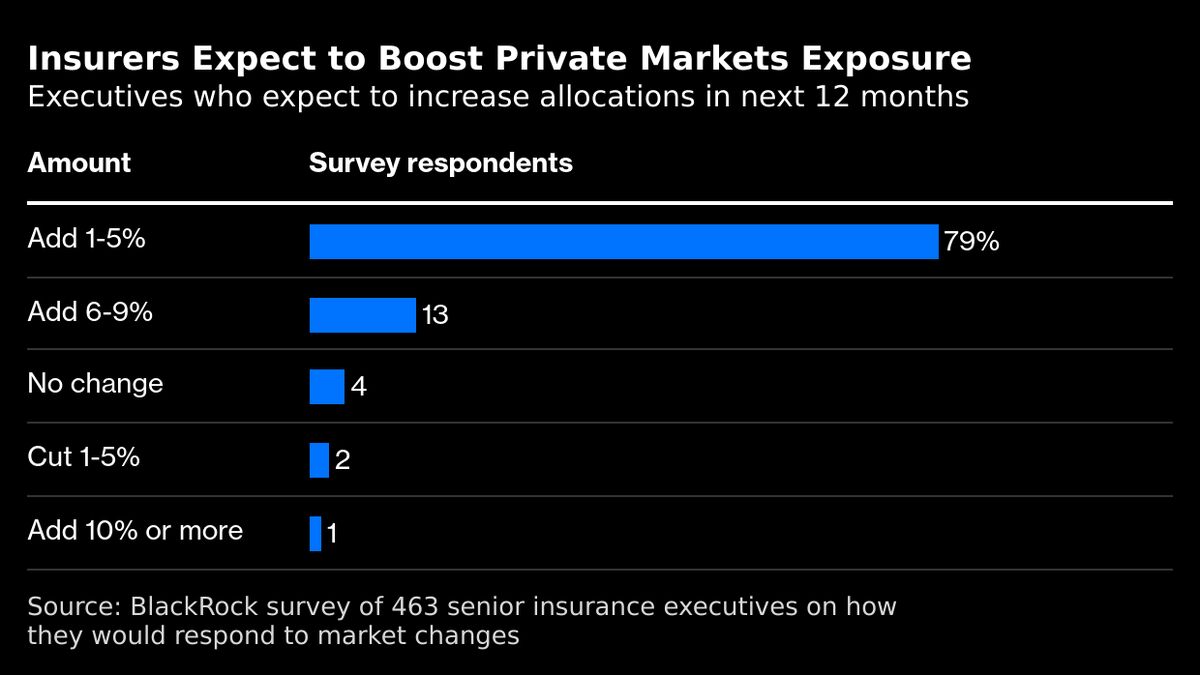

A recent survey by BlackRock reveals that insurers managing a staggering $23 trillion are planning to increase their investments in private markets. This move is aimed at enhancing long-term returns, which is significant for the financial stability of these institutions and their clients. As the market evolves, this trend could lead to more innovative investment strategies and opportunities for growth.

— Curated by the World Pulse Now AI Editorial System