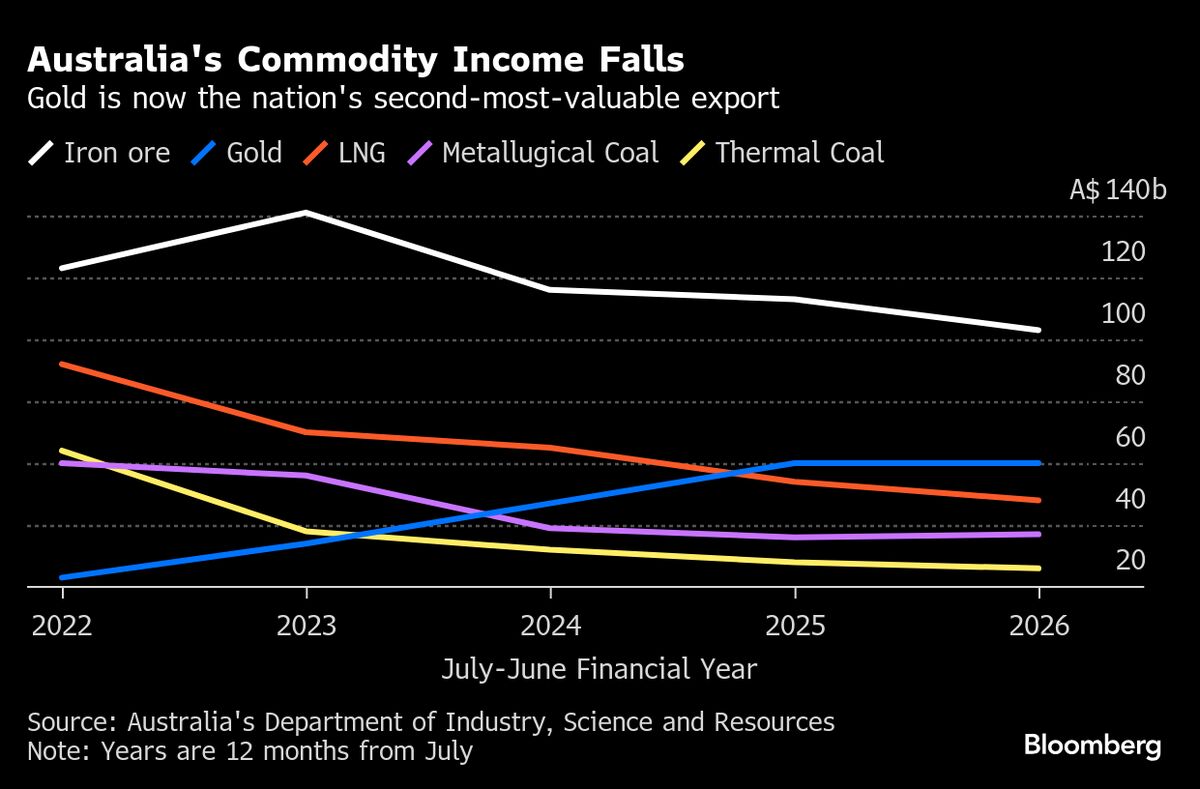

Gold to Overtake LNG And Metallurgical Coal as Australia’s Second Most Valuable Export

PositiveFinancial Markets

Australia is set to see gold surpass liquefied natural gas as its second most valuable export, thanks to a remarkable rise in gold prices. This shift highlights the growing importance of gold in the Australian economy and reflects broader trends in global commodity markets. As gold continues to gain value, it not only boosts the country's export revenues but also underscores the resilience of the mining sector amid fluctuating demand for other resources.

— Curated by the World Pulse Now AI Editorial System