Gold Price Nears $4,000 an Ounce, a Sign of Turmoil and Unease

PositiveFinancial Markets

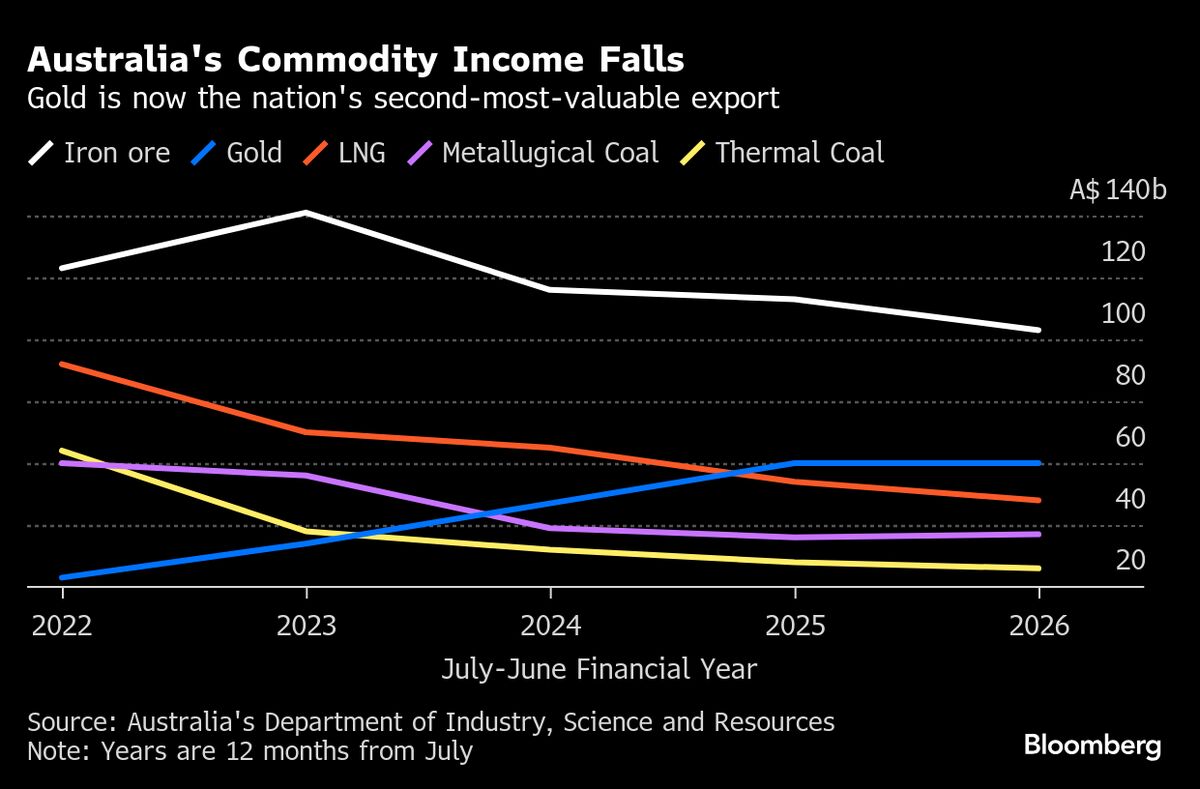

Gold prices are nearing $4,000 an ounce, marking a significant milestone and indicating a strong performance for the metal this year, the best since the 1970s. This surge reflects growing unease among investors, who often turn to gold as a safe haven during times of uncertainty. As global economic conditions fluctuate, the rising gold price serves as a barometer of investor sentiment and market stability.

— Curated by the World Pulse Now AI Editorial System