Trump, China's Xi Set to Meet in South Korea

PositiveFinancial Markets

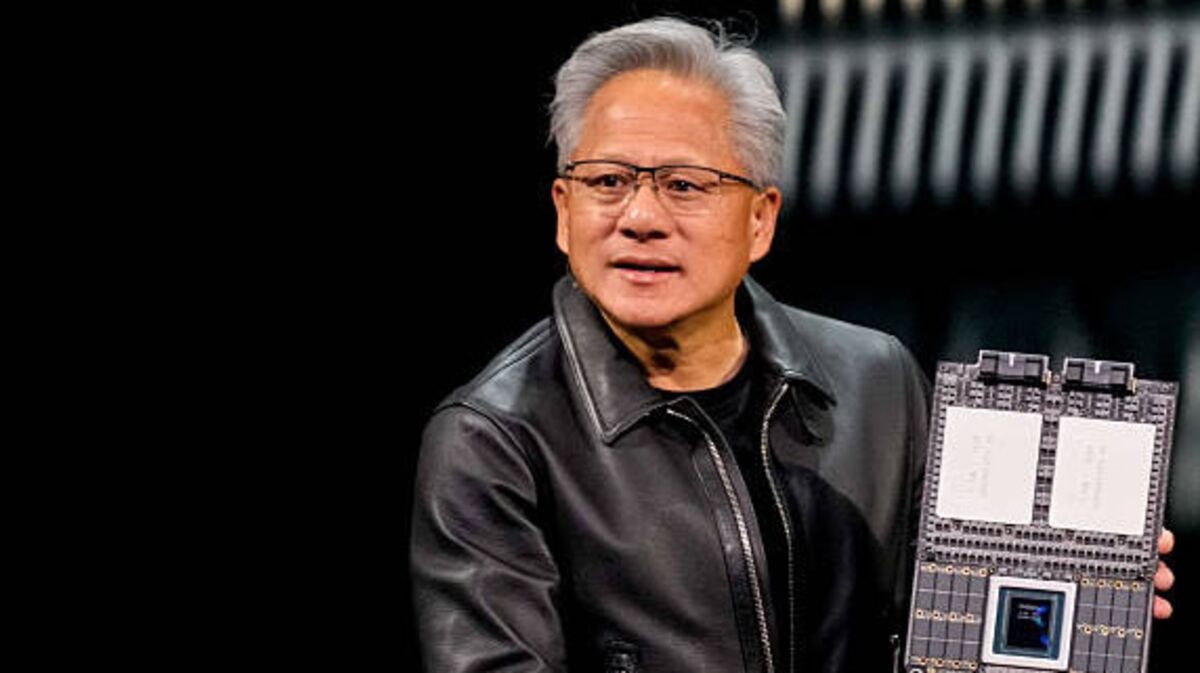

President Trump and China's Xi Jinping are meeting in South Korea to discuss a significant trade deal aimed at reducing tariffs and export restrictions. This meeting is crucial as it could pave the way for improved economic relations between the two countries, which have been strained recently. Additionally, Trump plans to address Nvidia's Blackwell AI technology, highlighting the importance of innovation in their discussions. The outcome of this meeting could have far-reaching implications for global trade.

— Curated by the World Pulse Now AI Editorial System