Saba capital buys ASA Gold & Precious Metals shares worth $1.9m

PositiveFinancial Markets

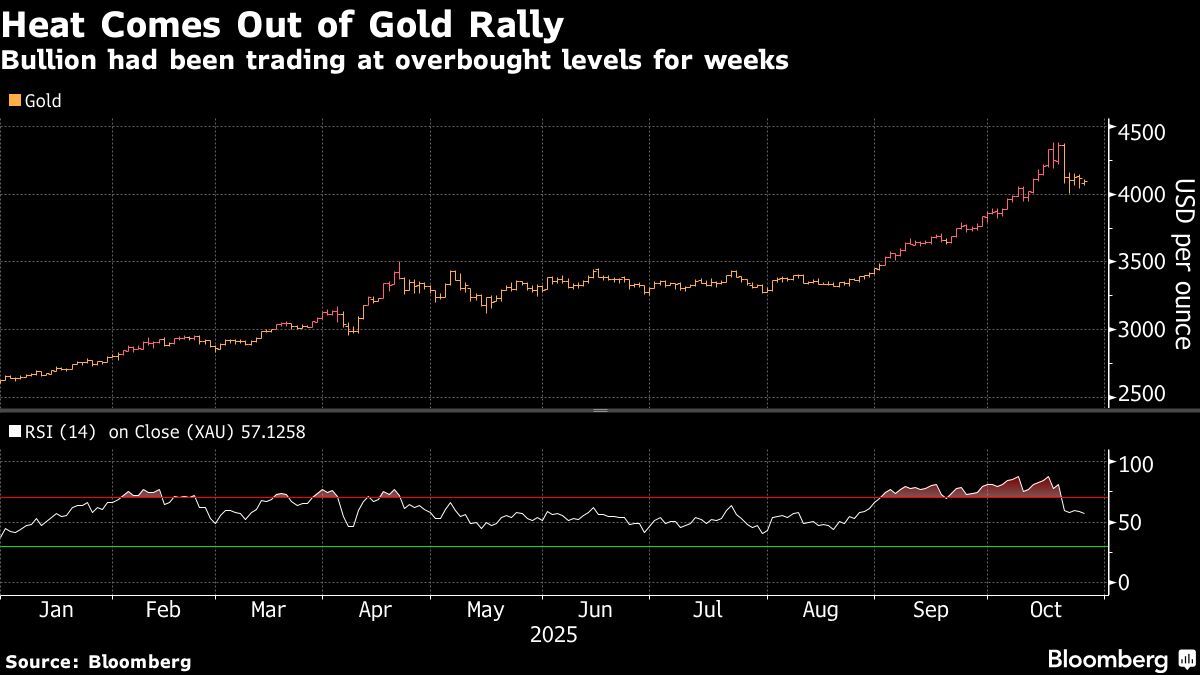

Saba Capital has made a significant investment by purchasing shares of ASA Gold & Precious Metals for $1.9 million. This move highlights Saba's confidence in the gold and precious metals market, which is often seen as a safe haven during economic uncertainty. Such investments can indicate a positive outlook for the sector and may attract further interest from other investors.

— Curated by the World Pulse Now AI Editorial System