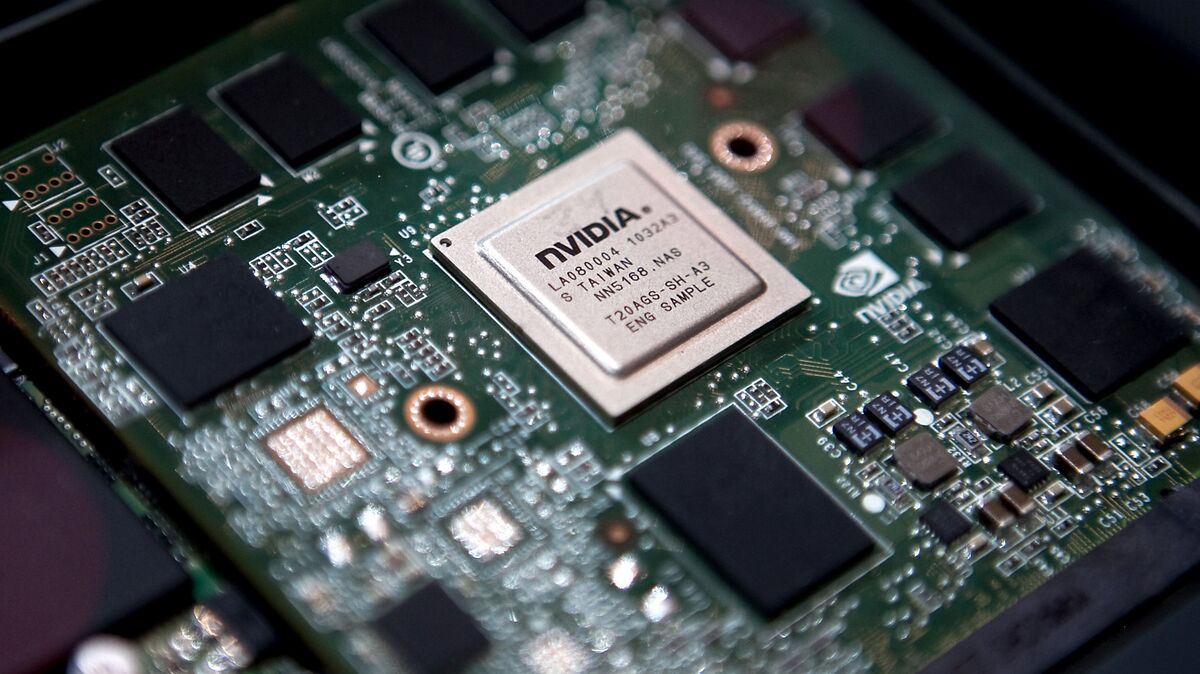

Nokia stock retreats, follows “excessive” rally tied to Nvidia partnership

NegativeFinancial Markets

Nokia's stock has taken a hit after a significant rally linked to its partnership with Nvidia. This decline is seen as a correction following what some analysts describe as an 'excessive' surge in stock prices. The partnership initially sparked investor enthusiasm, but the recent downturn highlights the volatility in the tech sector and raises questions about the sustainability of such rapid gains. Understanding these market dynamics is crucial for investors looking to navigate the complexities of tech stocks.

— Curated by the World Pulse Now AI Editorial System