US-China trade tensions escalate as tit-for-tat port fees come into effect

NegativeFinancial Markets

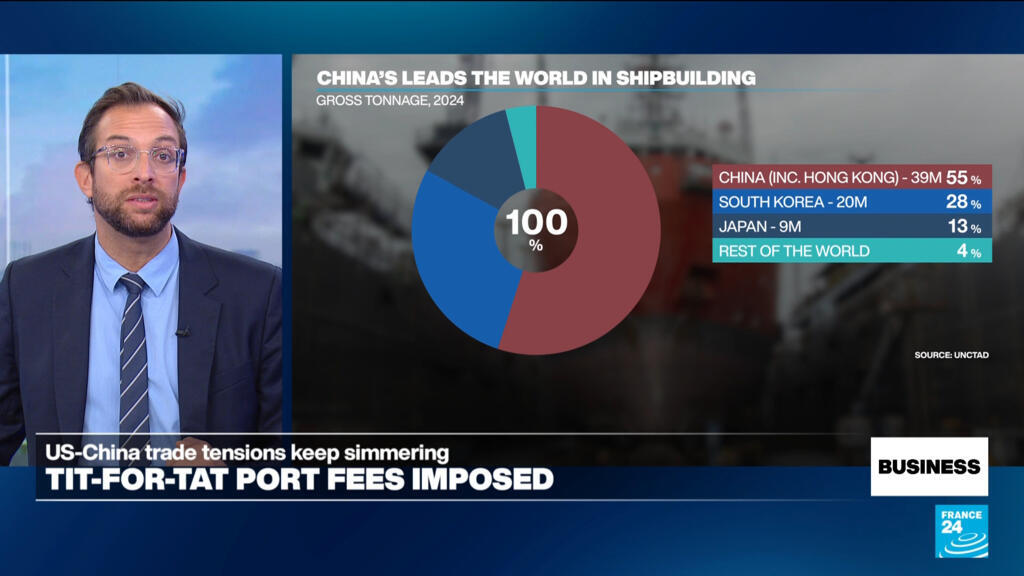

The recent implementation of port fees by both China and the US marks a significant escalation in their ongoing trade tensions. This move not only complicates the already strained relations between the two largest economies but also has serious implications for US soybean farmers, who are facing challenges due to China's suspension of soybean imports. Understanding these developments is crucial as they could affect global trade dynamics and economic stability.

— Curated by the World Pulse Now AI Editorial System