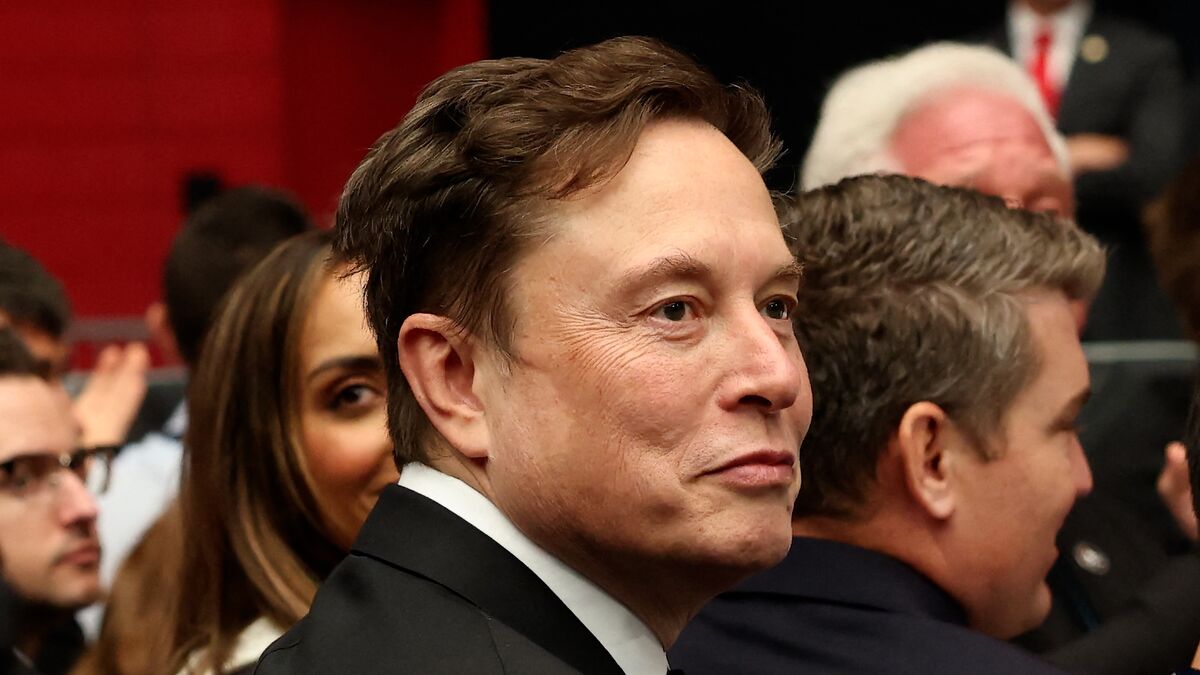

With $1 trillion pay package on the line, Elon Musk blasts influential firms telling shareholders to reject it: ‘Those guys are corporate terrorists’

NegativeFinancial Markets

Elon Musk has taken a strong stance against influential proxy advisory firms, urging shareholders to reject their recommendations regarding his $1 trillion pay package. He labeled these firms as 'corporate terrorists,' highlighting his frustration with their impact on corporate governance. This situation is significant as it underscores the tension between corporate leaders and advisory firms, which can shape shareholder decisions and influence company policies.

— Curated by the World Pulse Now AI Editorial System