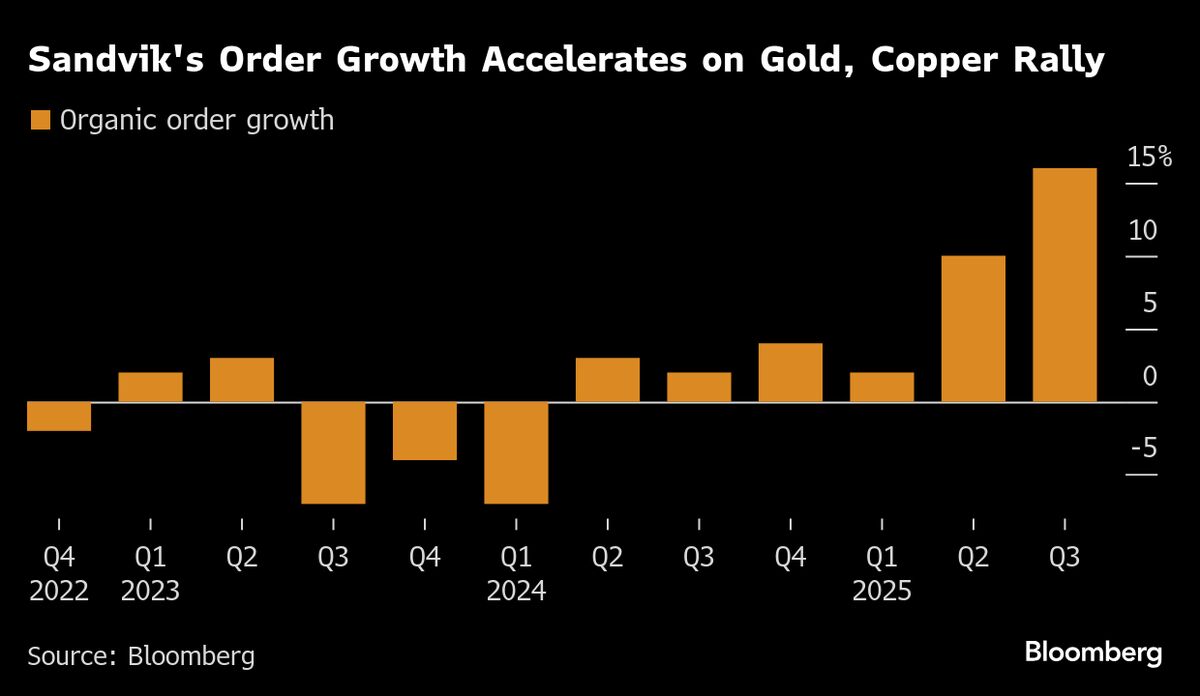

Sweden’s Sandvik Hits Record as Gold Rally Drives Orders

PositiveFinancial Markets

Sandvik AB has reached a record high in its shares, thanks to a surge in orders that exceeded expectations for the third quarter. This increase is largely driven by a rally in gold and copper prices, which has boosted demand for mining equipment and services. This is significant as it highlights the resilience of the mining sector and the potential for continued growth in response to commodity price fluctuations.

— Curated by the World Pulse Now AI Editorial System