Basic Materials Roundup: Market Talk

NeutralFinancial Markets

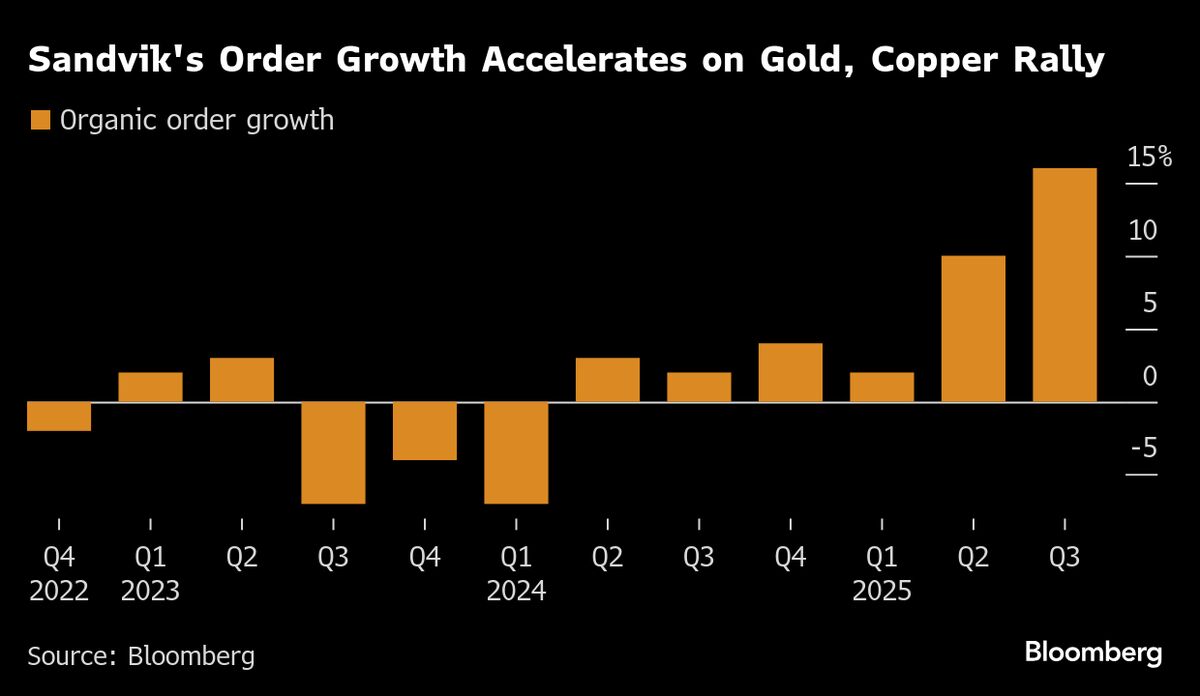

The latest Market Talks provide valuable insights into the basic materials sector, focusing on key commodities like gold and iron ore, as well as companies such as Iluka Resources. Understanding these market dynamics is crucial for investors and stakeholders as they navigate the fluctuations in commodity prices and assess potential investment opportunities.

— Curated by the World Pulse Now AI Editorial System