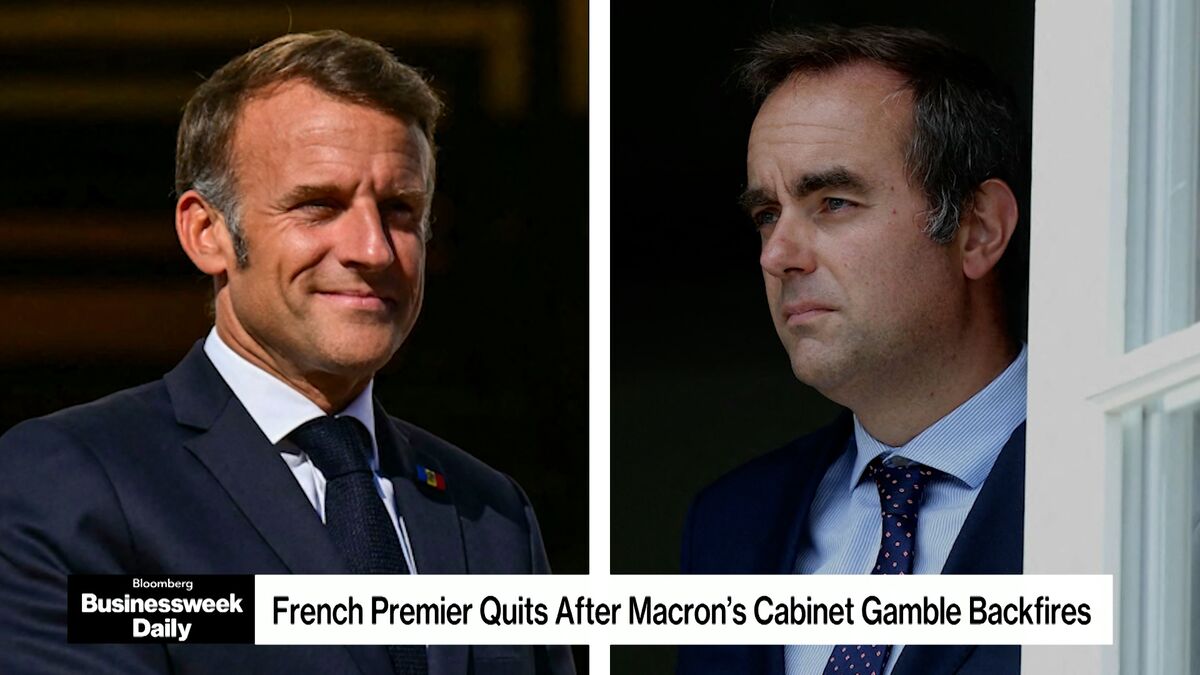

Macron Seeks Last-Ditch Talks to Salvage France Government

NegativeFinancial Markets

President Emmanuel Macron is in a tough spot as he gives his outgoing prime minister, Sebastien Lecornu, just 48 hours to negotiate with political parties in a desperate attempt to stabilize the French government. Lecornu's unexpected resignation highlights the deep divisions among political groups, which have hindered the formation of a new cabinet. This situation is critical as it could lead to further instability in France, affecting governance and public confidence.

— Curated by the World Pulse Now AI Editorial System