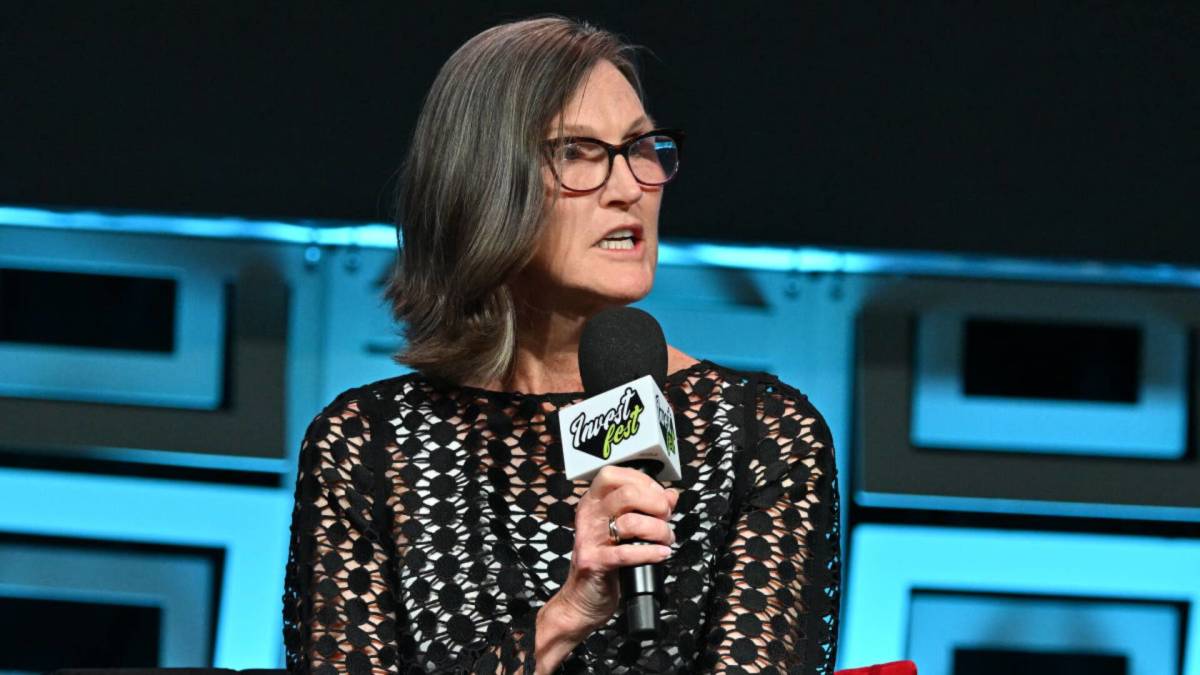

Cathie Wood's ARK buys Baidu stock, sells Brera Holdings

PositiveFinancial Markets

Cathie Wood's ARK Invest has made a strategic move by purchasing shares in Baidu while selling off its holdings in Brera Holdings. This shift highlights ARK's confidence in Baidu's potential for growth, especially as the company continues to innovate in AI and technology. Such decisions are significant as they reflect broader market trends and investor sentiment, showcasing ARK's proactive approach in navigating the evolving landscape of tech investments.

— Curated by the World Pulse Now AI Editorial System