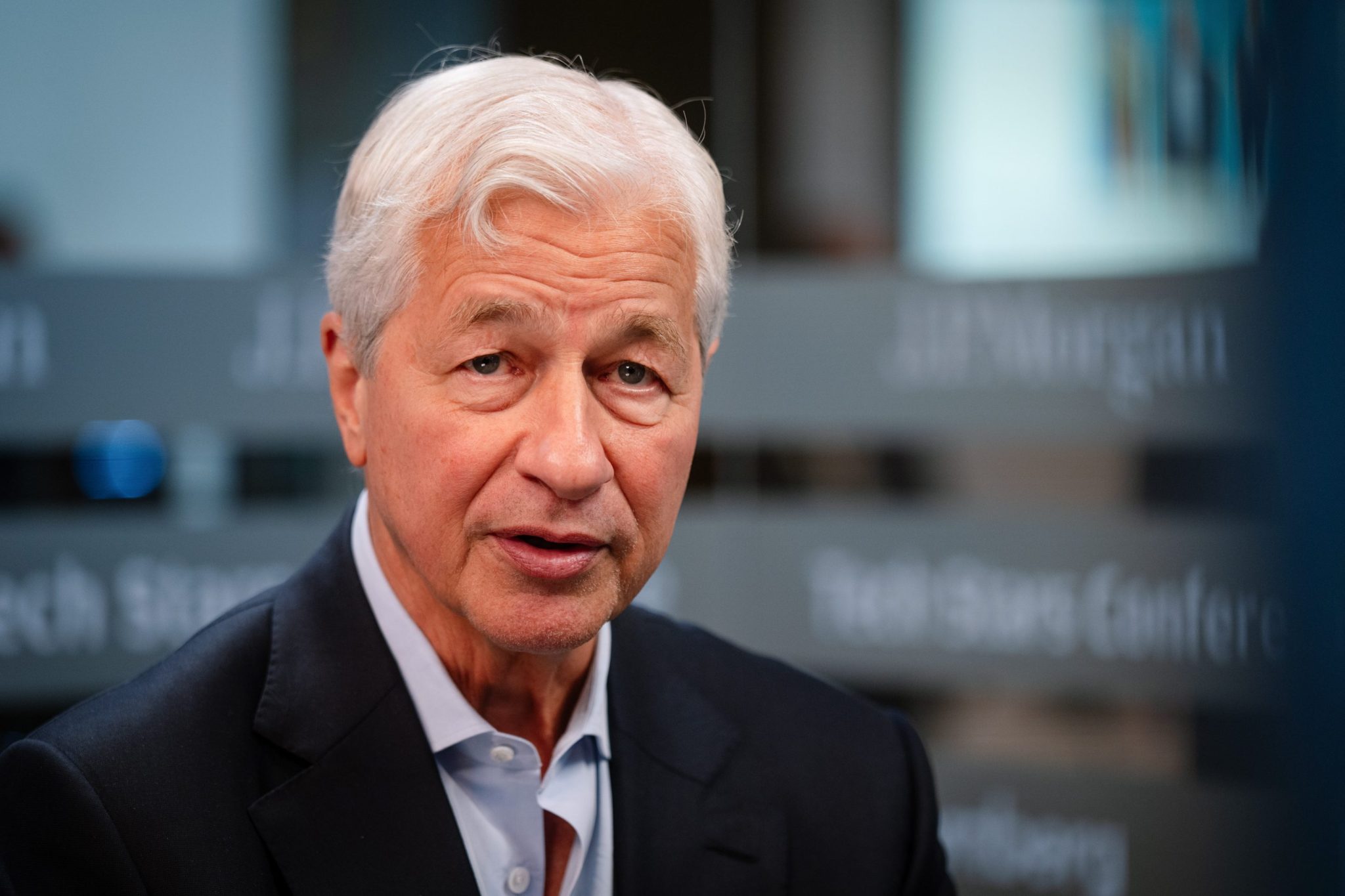

JPMorgan lifts interest income forecast after profit beats estimates

PositiveFinancial Markets

JPMorgan has raised its interest income forecast following a strong profit performance that exceeded analysts' expectations. This positive news reflects the bank's robust financial health and strategic positioning in the market, which is crucial for investors and stakeholders looking for stability and growth in the financial sector.

— Curated by the World Pulse Now AI Editorial System