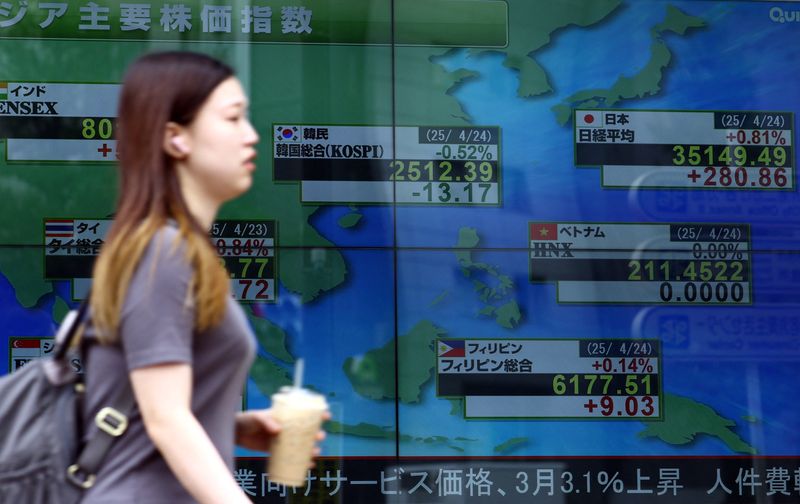

Asia FX gains, dollar dips amid US govt shutdown risks

NeutralFinancial Markets

In a recent development, Asian currencies have shown gains while the US dollar has dipped, primarily due to concerns surrounding potential government shutdown risks in the United States. This situation is significant as it reflects the interconnectedness of global financial markets and how political uncertainties can influence currency values. Investors are closely monitoring these developments, as they could impact trade and economic stability across the region.

— Curated by the World Pulse Now AI Editorial System