Gold Holds Near Record as Traders Weigh US Shutdown, Fed Rates

PositiveFinancial Markets

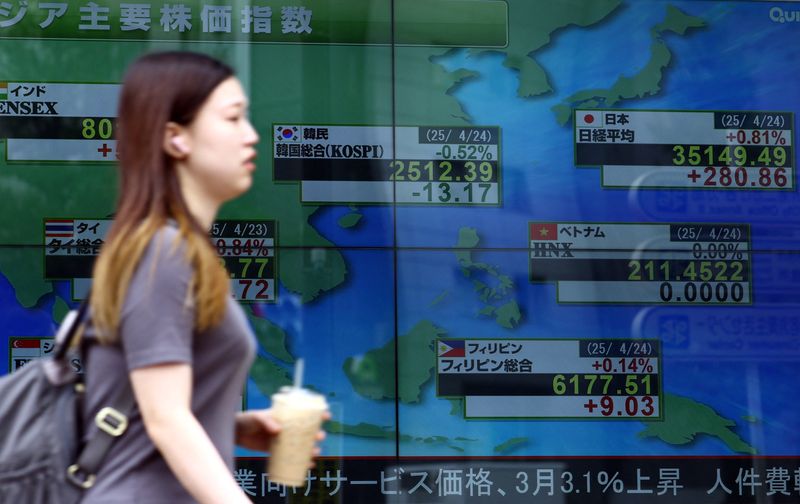

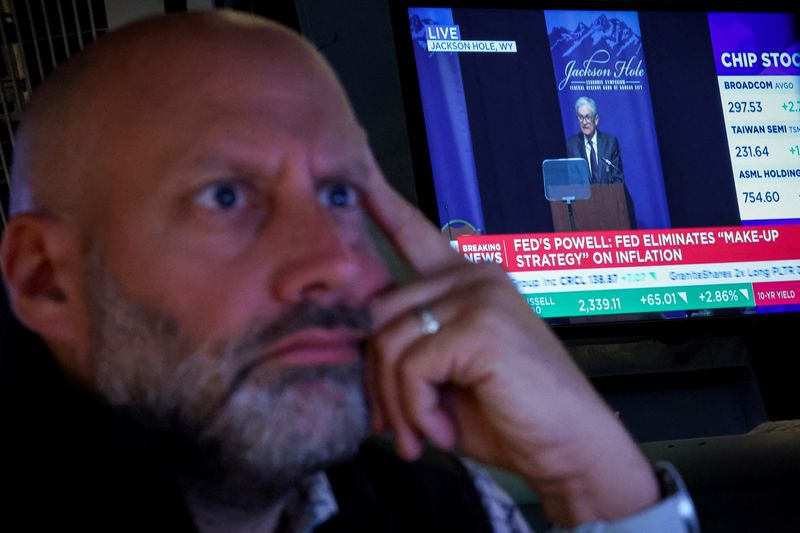

Gold prices are holding steady near record levels, reflecting a positive trend as traders consider the implications of a potential US government shutdown. This situation could delay important jobs data, which is crucial for understanding the Federal Reserve's future monetary policy. The ongoing strength in gold suggests that investors are seeking safe-haven assets amid uncertainty, making it a significant moment for the market.

— Curated by the World Pulse Now AI Editorial System