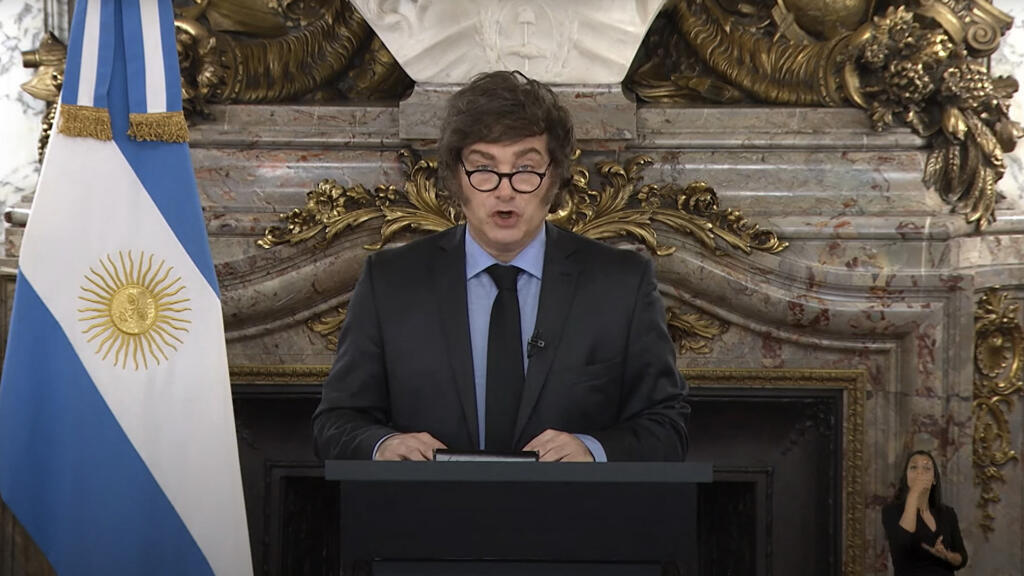

US Launches $20 Billion Rescue for Argentina Amid Currency Meltdown

PositiveFinancial Markets

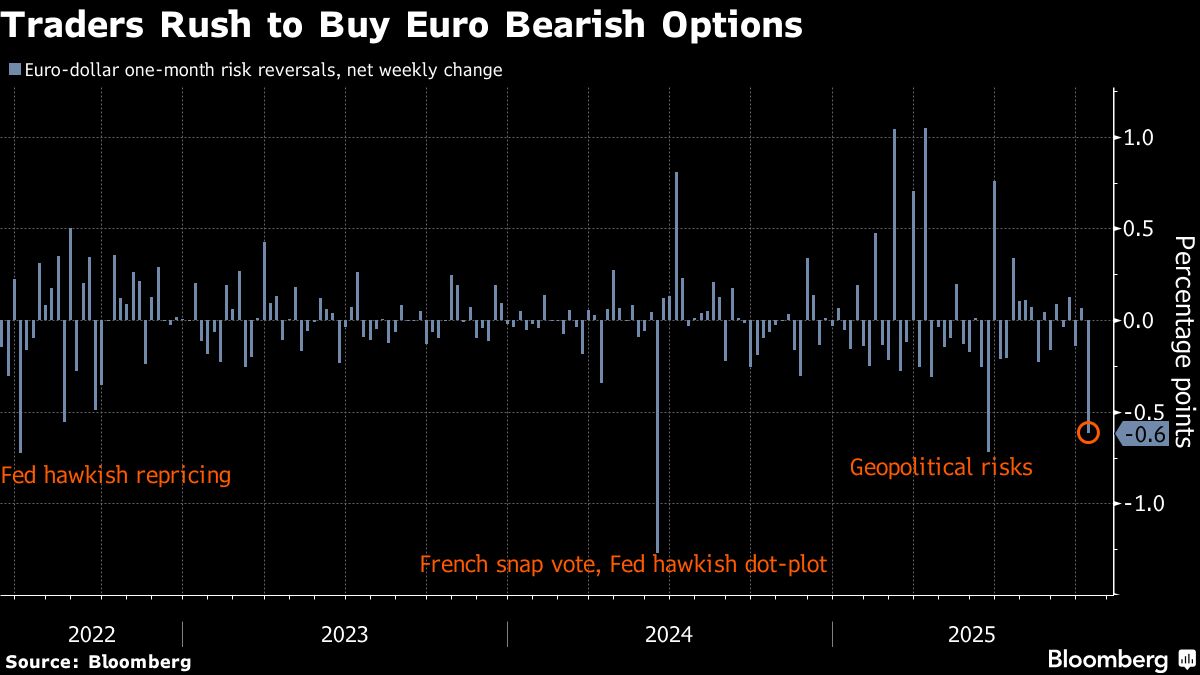

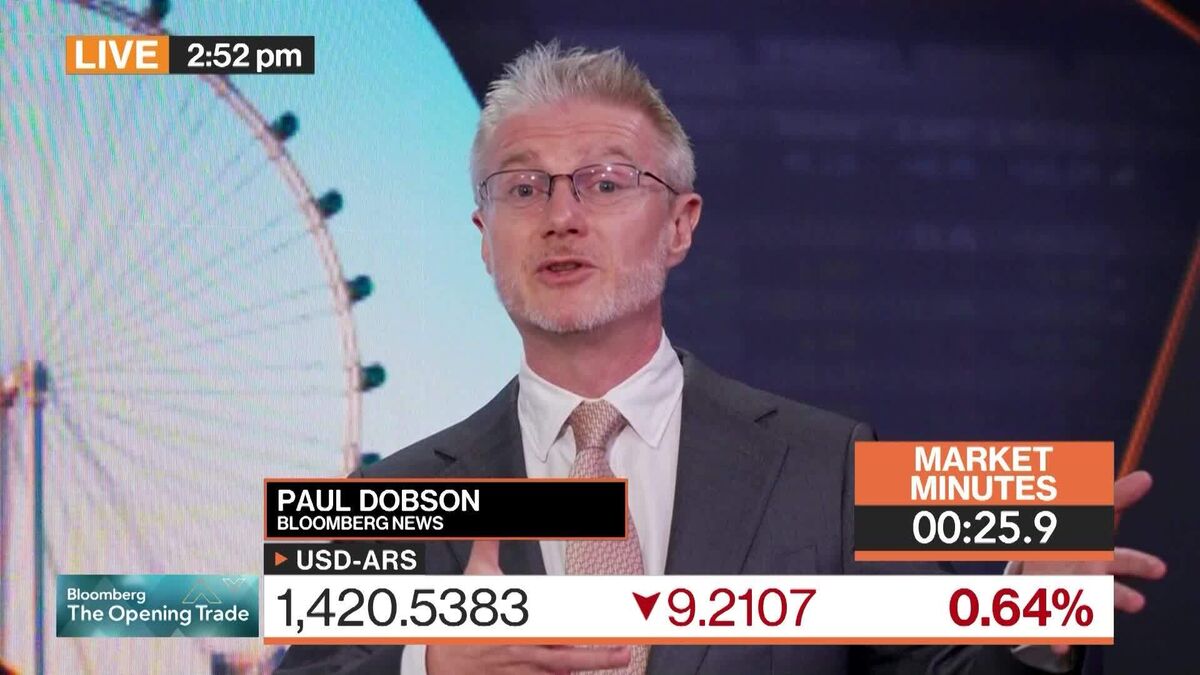

The United States has announced a significant $20 billion rescue package for Argentina, aimed at stabilizing the country's economy amid a severe currency crisis. This move is crucial as it not only provides immediate financial relief but also signals international support for Argentina's efforts to recover from economic turmoil. The aid is expected to help restore confidence in the Argentine peso and foster a more stable economic environment, which is vital for both local citizens and international investors.

— Curated by the World Pulse Now AI Editorial System