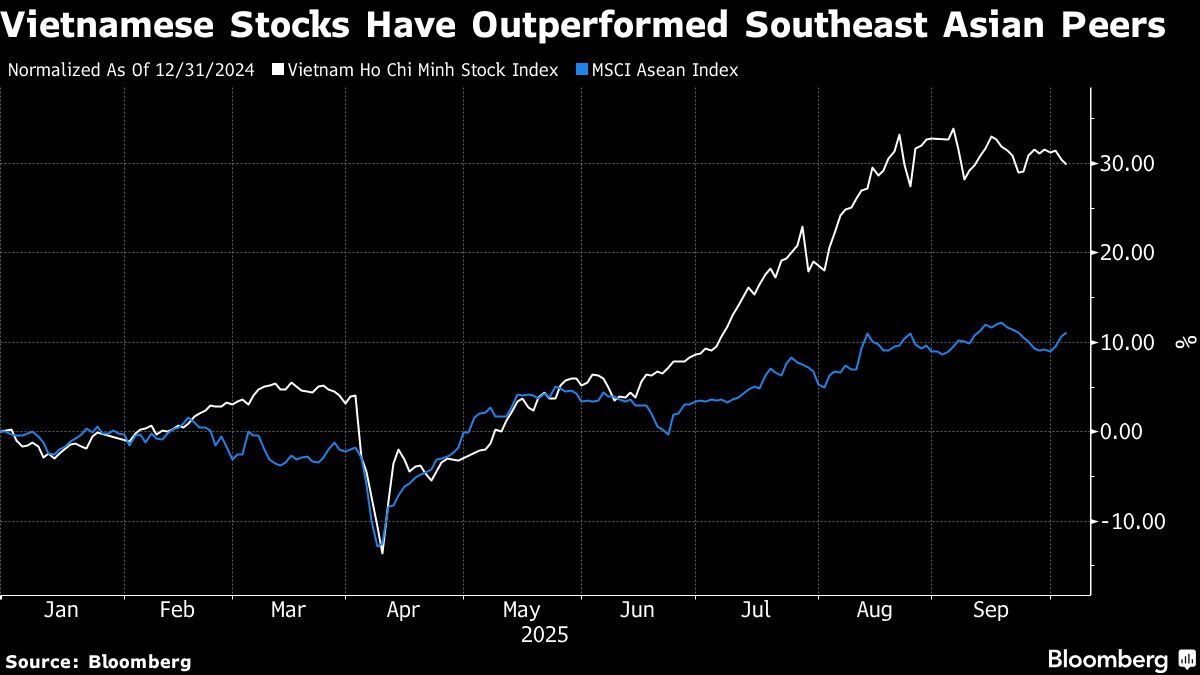

Vietnam's economy accelerates despite dip in US exports, footwear drop

NeutralFinancial Markets

Vietnam's economy is showing resilience as it continues to grow, even in the face of declining exports to the US and a drop in the footwear sector. This is significant because it highlights the country's ability to adapt and thrive despite external challenges, suggesting a robust domestic market and potential for future growth.

— Curated by the World Pulse Now AI Editorial System