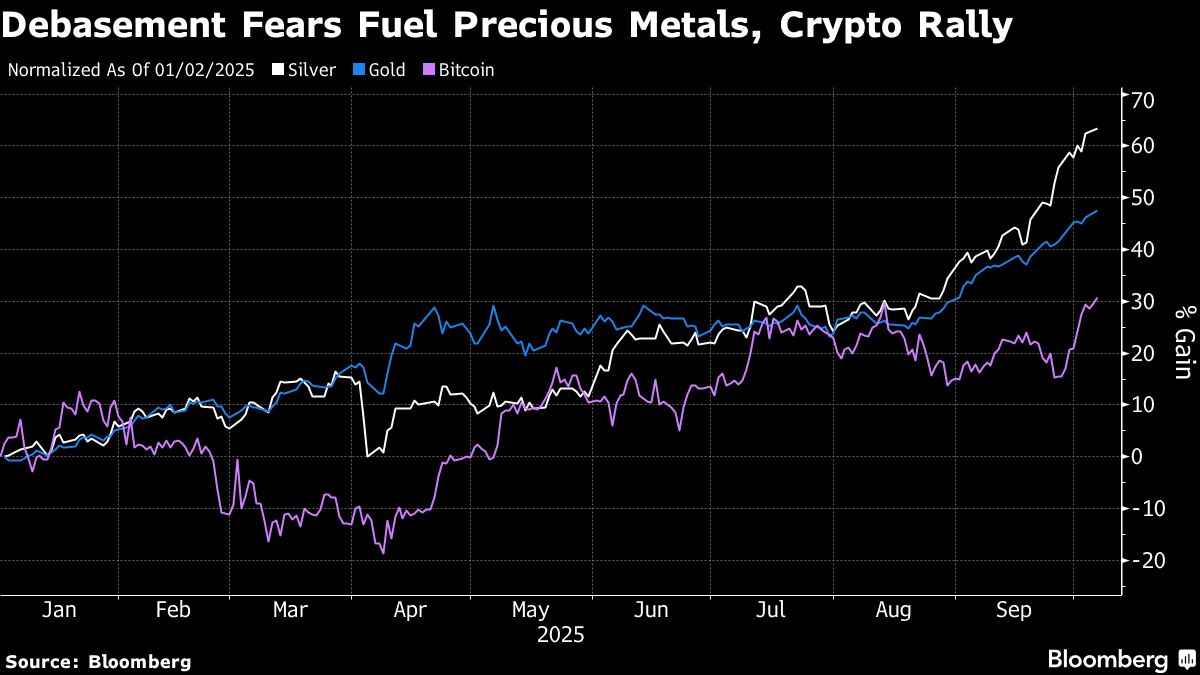

Political waves send Nikkei, bitcoin, gold soaring to record highs

PositiveFinancial Markets

Recent political developments have led to a surge in financial markets, with the Nikkei index, bitcoin, and gold reaching record highs. This upward trend reflects investor confidence and a positive outlook on the economy, making it a significant moment for both traders and the broader market. As these assets gain value, it highlights the interconnectedness of political events and financial performance, suggesting that investors are responding favorably to the current political climate.

— Curated by the World Pulse Now AI Editorial System