Analysts revamp Intel stock rating, send warning

NeutralFinancial Markets

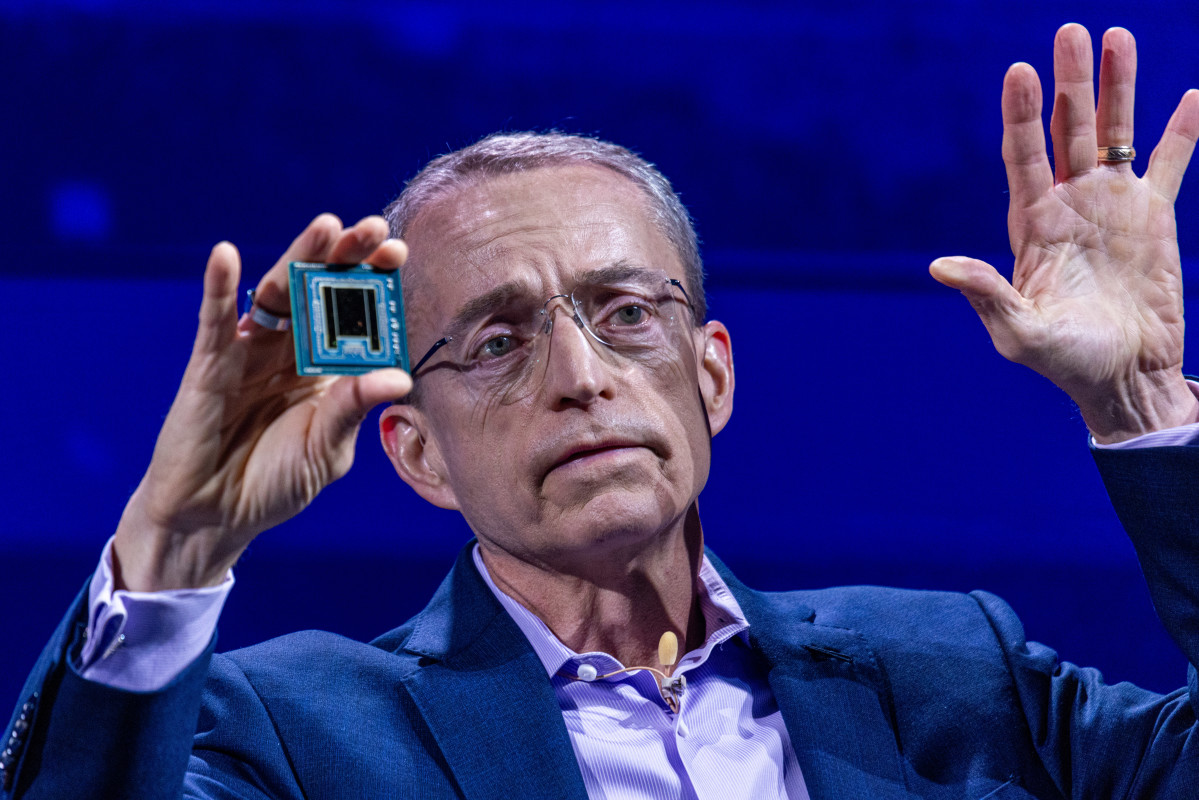

Intel is gearing up for the launch of its Panther Lake chips in January, promising significant improvements in CPU and GPU performance, alongside reduced power consumption. This news is important as it highlights Intel's efforts to stay competitive in the tech market, especially against rivals who are also innovating in chip technology.

— Curated by the World Pulse Now AI Editorial System