Former Intel CEO drops curt 2-word verdict on AI

PositiveFinancial Markets

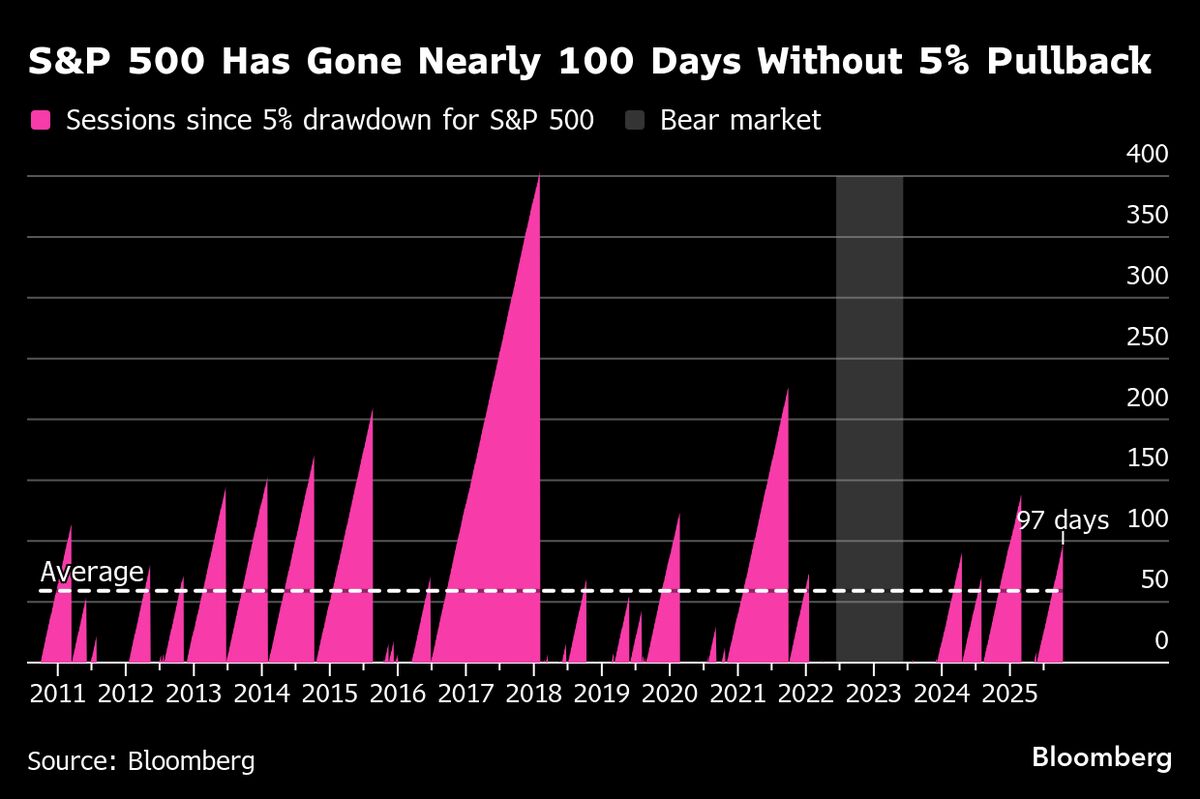

The former CEO of Intel recently shared a brief but impactful two-word verdict on artificial intelligence, highlighting its crucial role in driving the stock market, particularly the S&P 500. Over the past year, AI has been a significant factor in the market's resurgence, with increased investments in chip deals and data-center expansions. This trend not only reflects the growing confidence in AI technologies but also underscores their importance in shaping the future of the economy.

— Curated by the World Pulse Now AI Editorial System