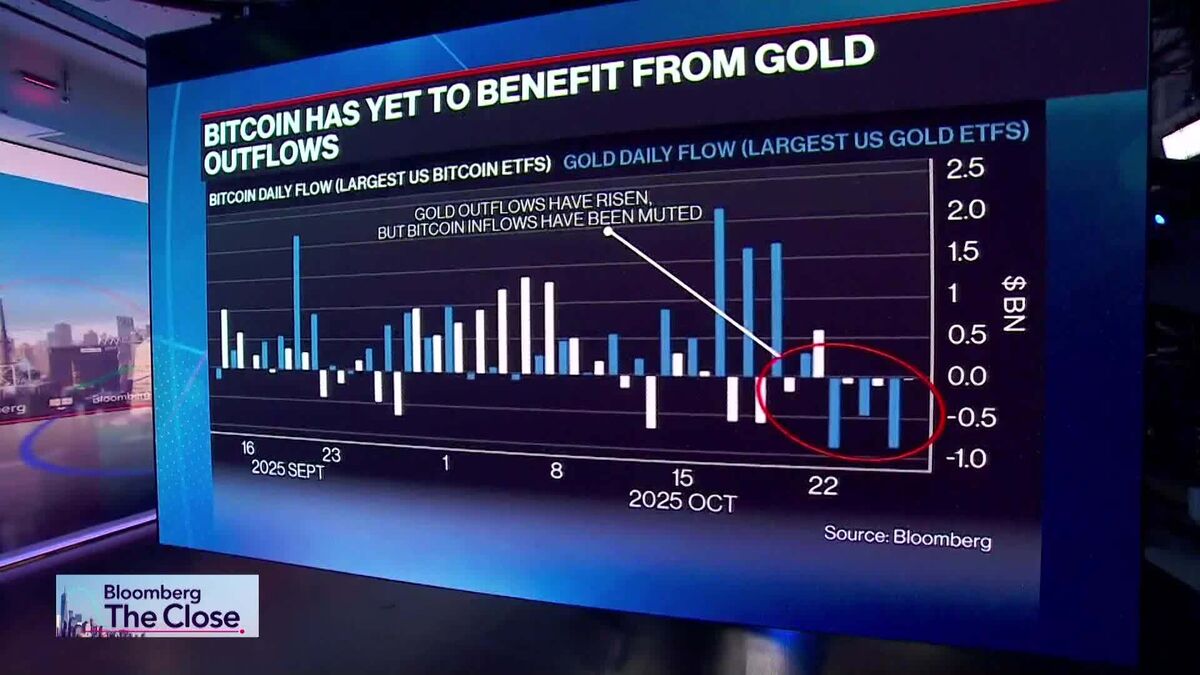

The FOMO-fueled gold bubble may now be turning into a ‘mini-bust,’ analysts say

NegativeFinancial Markets

Analysts are warning that the recent surge in gold prices, driven by fear of missing out (FOMO), may be reaching its peak and could soon lead to a mini-bust. This matters because it highlights the volatility of the gold market and the potential risks for investors who may be caught up in the hype.

— Curated by the World Pulse Now AI Editorial System