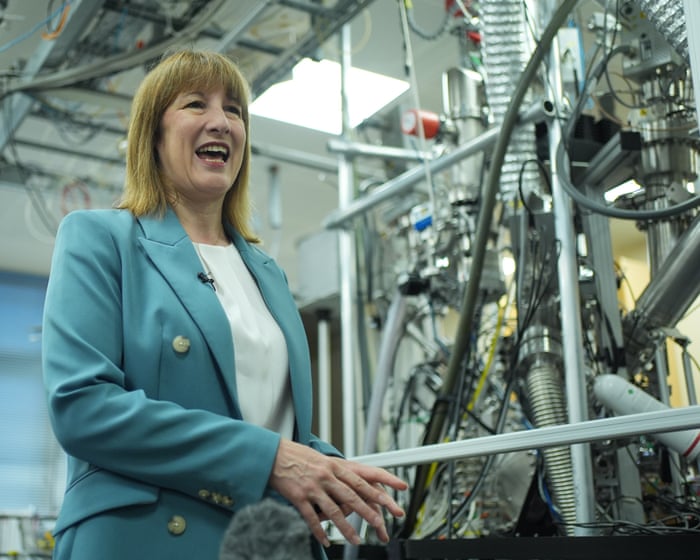

Rachel Reeves given extra £3bn for budget after VAT error fixed

PositiveFinancial Markets

Rachel Reeves has received an additional £3 billion for her upcoming budget after the Office for National Statistics (ONS) corrected a significant error in public finance data. This adjustment revealed that government borrowing had been overstated by £200 million to £500 million each month since January. This correction not only provides Reeves with more financial flexibility for her November budget but also highlights the importance of accurate financial reporting in government planning.

— Curated by the World Pulse Now AI Editorial System