Nike sends disappointing message to loyal customers

NegativeFinancial Markets

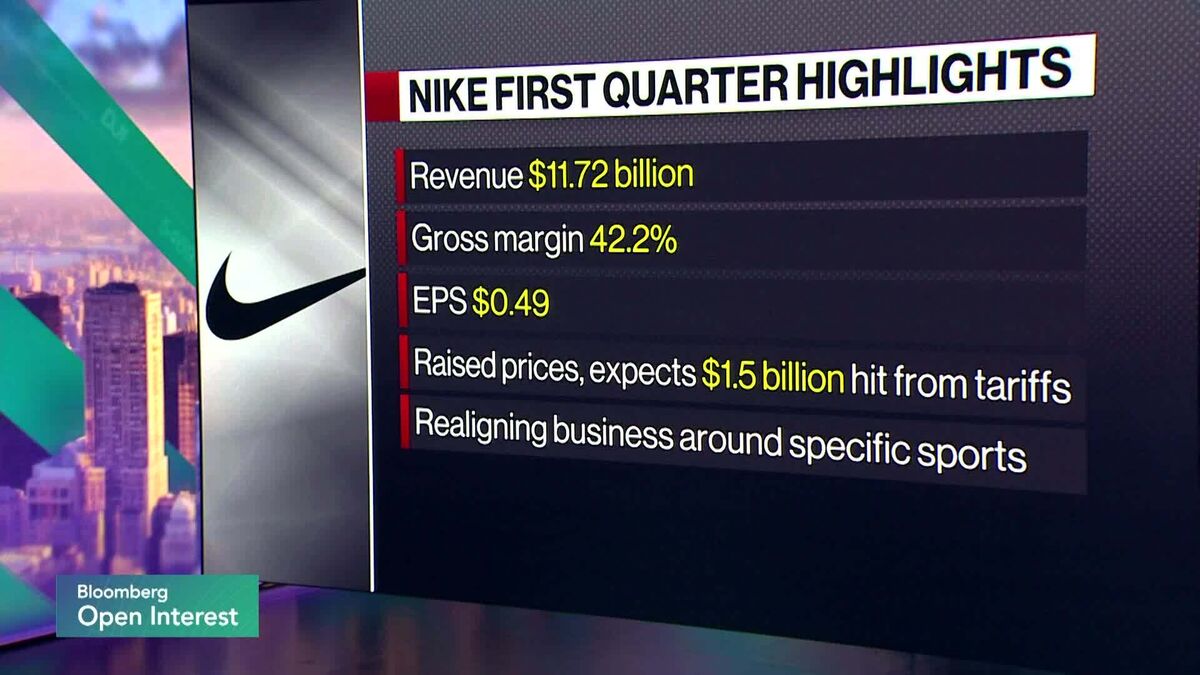

Nike's recent decisions have left many loyal customers feeling disappointed. The iconic sports brand is facing challenges that are prompting tough choices, which could impact its relationship with consumers. This situation matters because it highlights the struggles even well-established brands face in maintaining customer loyalty amidst changing market dynamics.

— Curated by the World Pulse Now AI Editorial System