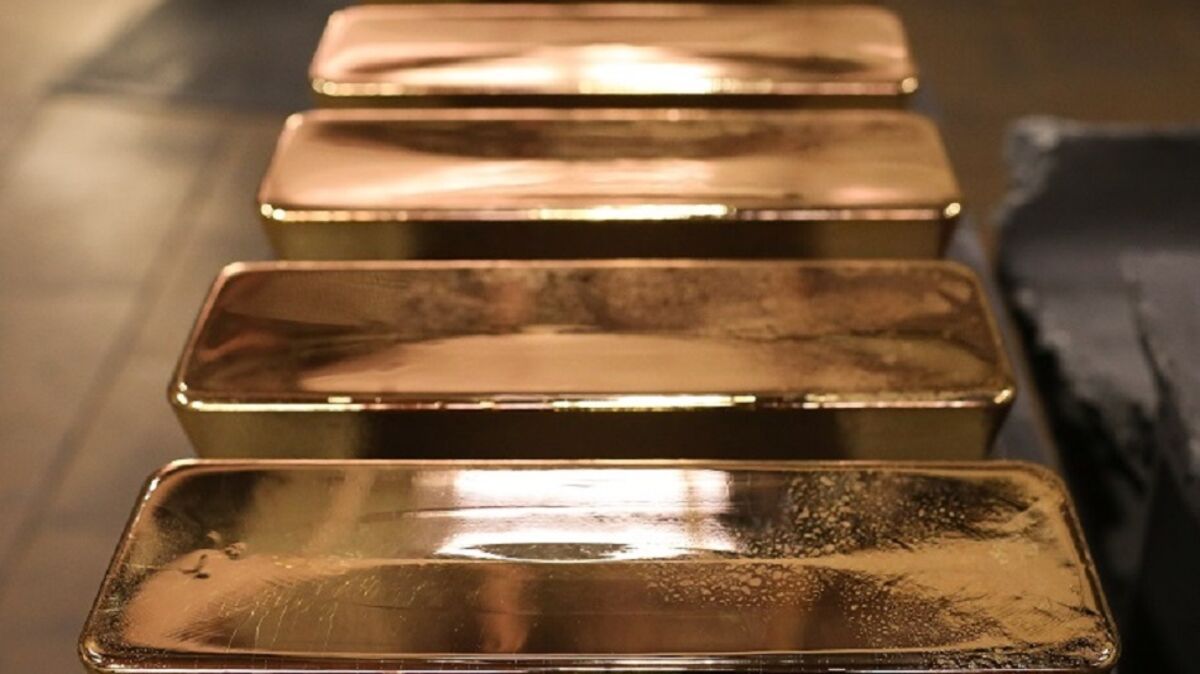

At this rate, the price of gold could soar to $10,000 per ounce in just three years

PositiveFinancial Markets

The price of gold is on a remarkable upward trajectory, with predictions suggesting it could reach $10,000 per ounce within the next three years. This potential surge is significant as it reflects growing investor confidence and economic uncertainty, making gold a sought-after asset. Such a rise would not only impact investors but also influence global markets and economies, highlighting the precious metal's enduring value.

— Curated by the World Pulse Now AI Editorial System