Huntington’s profit jumps on higher interest, fees

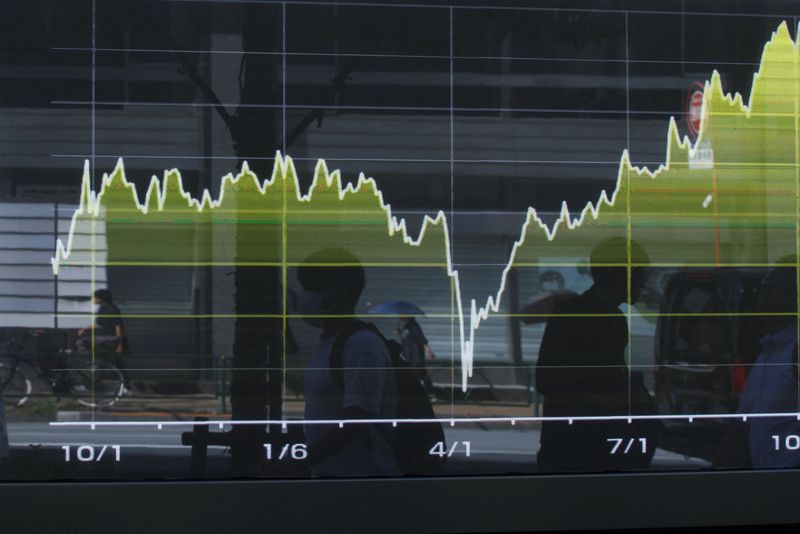

PositiveFinancial Markets

Huntington Bank has reported a significant increase in profits, driven by higher interest rates and fees. This surge is noteworthy as it reflects the bank's ability to capitalize on the current economic environment, which could signal a positive trend for the financial sector. Investors and customers alike may find this development reassuring, as it suggests stability and growth potential in the banking industry.

— Curated by the World Pulse Now AI Editorial System