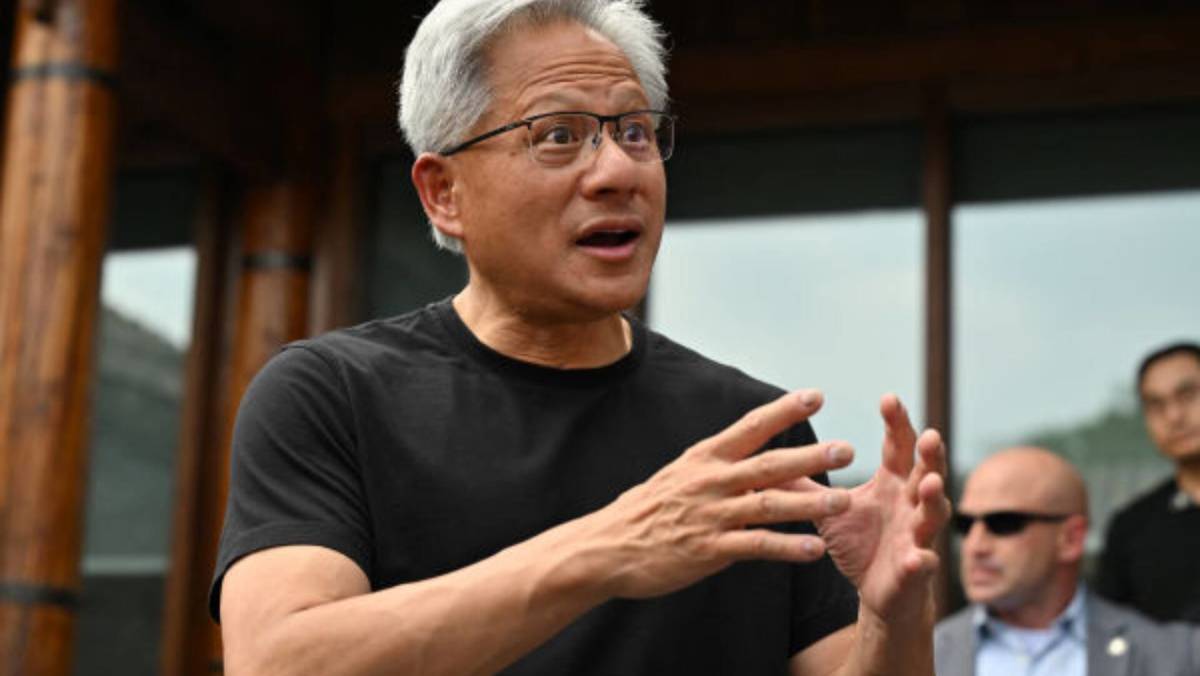

Legendary fund manager drops bombshell call on Nvidia stock

NeutralFinancial Markets

A prominent former fund manager from Baillie Gifford has made a surprising announcement regarding Nvidia stock, which has caught the attention of investors. This unexpected call could influence market perceptions and trading strategies, highlighting the volatility and unpredictability of tech stocks.

— Curated by the World Pulse Now AI Editorial System