Strong Movie Slate Ahead for 2026: IMAX CEO

PositiveFinancial Markets

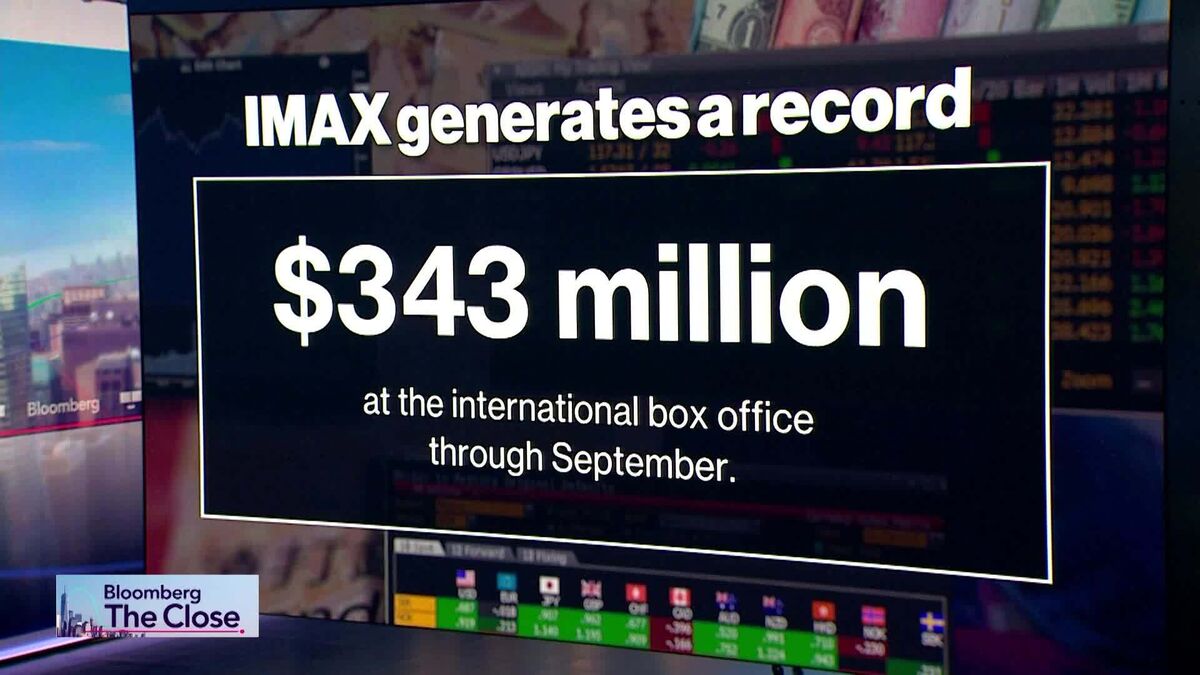

IMAX CEO Richard Gelfond is optimistic about the future of cinema, revealing that a strong lineup of films is set to hit theaters by 2026. He acknowledges the challenges posed by the pandemic and industry strikes but highlights that IMAX's theater growth has been particularly robust in regions like Japan, the Middle East, Australia, and North America. This is significant as it indicates a rebound in the film industry and a renewed interest in cinematic experiences, which could lead to a revitalization of theaters worldwide.

— Curated by the World Pulse Now AI Editorial System